5 Legit Ways to Get Free Gas Cards

Our readers always come first

The content on DollarSprout includes links to our advertising partners. When you read our content and click on one of our partners’ links, and then decide to complete an offer — whether it’s downloading an app, opening an account, or some other action — we may earn a commission from that advertiser, at no extra cost to you.

Our ultimate goal is to educate and inform, not lure you into signing up for certain offers. Compensation from our partners may impact what products we cover and where they appear on the site, but does not have any impact on the objectivity of our reviews or advice.

Gas is expensive, but that doesn’t mean you have to break the bank to get around town. Using these 5 ways to get free gas, you can consistently save money at the pump.

Our mission at DollarSprout is to help readers improve their financial lives, and we regularly partner with companies that share that same vision. If a purchase or signup is made through one of our Partners’ links, we may receive compensation for the referral. Learn more here.

Are you spending too much money on gas? Would getting free gas cards every now and then help?

Gas prices are rising again, and that means lots of drivers are looking for ways to save money on fuel.

That includes everything from switching to a more fuel-efficient car to driving around in search of the best prices at the pump, only to save a few cents.

As it turns out, there are several ways to get significant discounts on gas, including getting free gas cards.

5 Legit Ways to Get Free Gas Cards

We’ve compiled a list of all the best ways to fill up your tank for free. If you’re looking for ways to save money on gas, check out these 5 ideas that will help pay for gas without breaking the bank.

1. Get free gas cards online

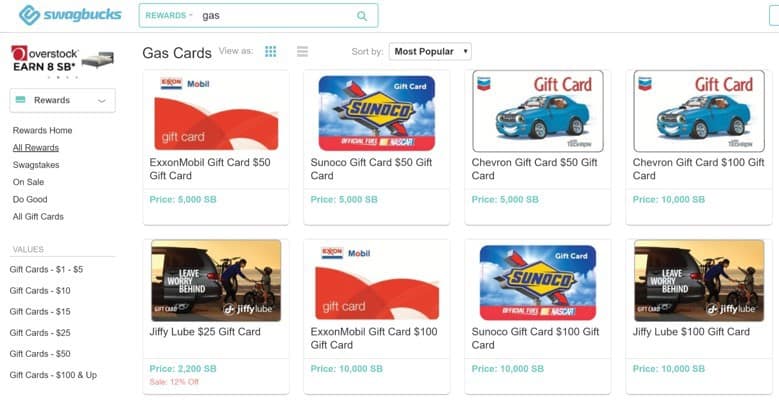

There are a lot of sites out there offering free stuff, but most are scams. Swagbucks is a reliable and legit way to get free gas cards. Swagbucks is a site that rewards users for doing all kinds of simple tasks online, like taking surveys, watching videos, and shopping. There are even rewards for using its search engine and playing games.

Swagbucks awards points for completing these activities, which you can trade in for gift cards. Every 100 points is worth $1. At 5,000 points you can trade in for a $50 gift card to Sunoco, Exxon Mobil, or Chevron gas stations.

Or, you can wait until you’ve accumulated 10,000 points and snag a $100 gas card. That’s more than enough to fill up even the biggest SUVs, and you won’t have to pay a single cent.

Related: Swagbucks Review 2025

2. Use cash back & rewards credit cards

Lots of credit card companies offer rewards just for using your card. It’s smart to take advantage of these rewards programs, as long as you pay off the balance of your card in full each month. Otherwise, you’ll end up paying more in interest than you make in rewards.

That being said, there are some cards that can save you money on gas and get you closer to filling up your tank for free.

Blue Cash Preferred Card from American Express

The Blue Cash Preferred Card from American Express has a nice cash back bonus. You can earn 3% cash back for any purchase made at a gas station (including gas).

There’s no limit to how much you can earn, either. If you drive a lot or have a gas-guzzler, this card is a great option. You’ll also earn 6% cash back at supermarkets on purchases up to $6,000 per year and 1% back on everything else.

Chase Freedom Card

The Chase Freedom Card also offers cash back on gas purchases, but you may have a harder time redeeming this reward. Chase Freedom has quarterly rotating reward categories where you can earn 5% cash back on purchases up to $1,500.

At least one quarter per year features gas stations as a reward category. You have to activate the rewards online with this card, so make sure you pay attention and get cash back for gas when you can.

Discover It Card

The Discover It Card is very similar to the Chase Freedom Card. It also utilizes a quarterly rotating reward system allowing you to earn 5% back on purchases up to $1,500.

Like the Chase Freedom Card, the Discover It Card also features gas stations one quarter per year and requires you to activate deals online.

3. Participate in market research

Although Swagbucks is great because it offers so many ways to earn rewards, there are lots of sites where you can just complete surveys for rewards.

Marketing companies want to know what consumers are thinking, and they’ll pay for that information via online surveys. These sites are reliable and offer money you can use for gas in exchange for your survey responses.

Survey Junkie is one of the better survey sites, especially if you want to get free gas. It’s free to join and it actually pays you for every survey.

One of the biggest problems with survey sites is that you might start taking a survey and spend 5 minutes filling in your personal information, only to be told that you don’t qualify for that survey. You’re left with no money and you’ve wasted your time. With Survey Junkie, you get paid even if you don’t qualify.

Each survey is worth a different number of points, and every 100 points is worth $1. Once you’ve earned 500 points you can cash out. You can choose from a few free gift cards or just get cash via PayPal. Survey Junkie doesn’t always offer gas cards, so PayPal is the best way to get money for gas.

Other Top-Rated Survey Sites

- Freecash.com ($5 sign-up bonus)

- Branded Surveys ($1 sign-up bonus)

- InboxDollars ($5 sign-up bonus)

4. Buy discounted gas cards online

If you’d rather not spent your time taking surveys online, you can search for discounted gas cards online. Every day, people receive gift cards that they don’t want or need, including gas cards.

While some people put them in a drawer and never spend them, others sell them online for a little cash. With these websites, you can buy unwanted gift cards for less than their face value and save money.

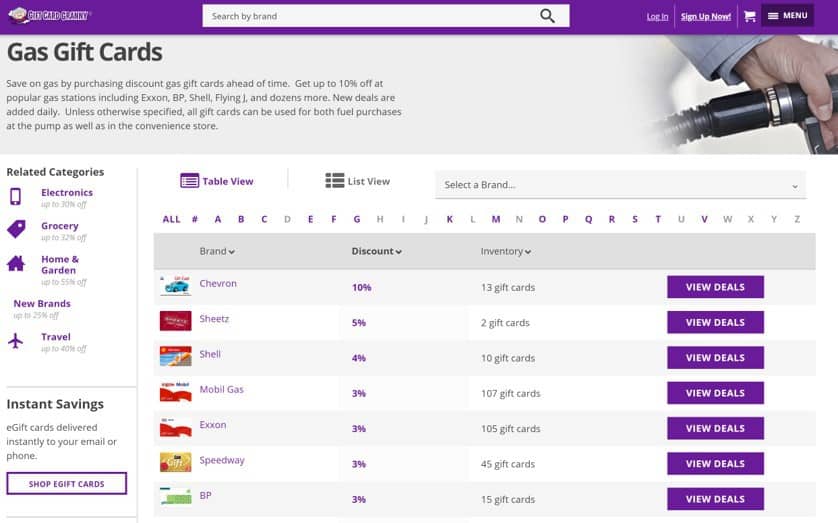

Gift Card Granny

Gift Card Granny might be the best site for buying cheap gift cards. On Gift Card Granny, it’s easy to find discounted gas cards that save you 5% or even 10%. The selection varies widely, depending on what other users have sold. But the savings are far greater than you’ll get on other gift card sites.

There are plenty of cards available for big gas station brands like BP, Speedway, and Exxon Mobil. If you’re willing to spend a little money upfront, you can save a lot at the pump with these gift cards.

Raise

Raise also buys gift cards from people who don’t want them and resells them for discount prices. You can search its site for all kinds of gift cards, including cards for gas stations like BP, Speedway, Sheetz, Citgo, and tons more.

But don’t expect huge savings here. Most gas cards on Raise will only save you about 2%. If you watch the site carefully, you can sometimes find better deals that are worth snapping up. Plus, Raise offers $10 off your first purchase of $100 or more. This deal makes the site worth using at least once.

Related: Raise Review 2025

5. Grocery stores offering gas points

Just about every grocery store today has some kind of loyalty rewards card. These cards typically unlock extra savings for members and don’t cost anything to use. In return, stores hope you’ll shop with them more frequently. A few stores offer really great deals, including big savings on gas when you spend more with them. Take advantage of the extra fuel savings by shopping at these stores.

Kroger

When you sign up for a loyalty card at Kroger, you’ll get more than just savings on groceries. You’ll also earn points that you can redeem at Kroger Fuel Centers or Shell gas stations. For every $1 spent on groceries, you get 1 point. With 100 points, you can cash in for $0.10 off every gallon the next time you fuel up.

It’s a good deal, and there are ways to save even more money. At Kroger Fuel Centers, you can save up until you have 1,000 points and cash in for $1 off per gallon. Plus, you earn 2 points for every $1 you spend on gift cards, making it even easier to earn points and get free gas.

Safeway

Shopping at Safeway can also save you big on gas, with a rewards program that’s almost identical to Kroger’s. For every dollar you spend using your Safeway Club Card, you earn 1 point toward gas rewards at Safeway, Chevron, or Texaco stations. Save up 100 points and you can get $0.10 off per gallon when you fill up. If you save up 1,000 points, you can get $1 off per gallon. Gift cards also earn you double reward points here, so you’ll get big discounts on gas even quicker.

Stop and Shop

Stop and Shop offers a fuel savings program just like Kroger and Safeway. Earn a point for every dollar you spend using your rewards card, and cash in for $0.10 off per gallon once you have 100 points. Stop and Shop allows you to save up 1,500 points and cash in for $1.50 off each gallon. That gives you the potential to save almost 50% on gas, depending on the season and where you live.

Winn Dixie

Winn Dixie’s loyalty program is one of the best if you spend a lot on groceries and want to earn some free gas. Earn points by shopping at Winn Dixie. Once you have 100 points, you can cash in for $0.05 off each gallon of gas the next time you fuel up.

What makes this program so great is that you can earn bonus points for buying certain items, and gift cards earn you triple points. There’s another awesome bonus, too—there’s no limit to how many points you can use when you cash in. That means if you save up enough points, you could fill up your gas tank for free!

Other Ways to Save on Gas

If you’re still spending too much on gas each month, consider reducing the amount of fuel you use. That doesn’t mean you have to stop driving completely. A few changes can help you save hundreds with little or no effort.

6. Get a more fuel-efficient vehicle

Today’s vehicles are more fuel-efficient than ever. There are all kinds of cars equipped with new technology that will help you save fuel. These fuel-efficient eco-friendly models are no longer just funny-looking hatchbacks. Even trucks and SUVs that used to be gas guzzlers are now available in hybrid or fuel-efficient models.

New hybrid models are also making it easier to save on fuel, and plug-in hybrids are bringing electric cars within the reach of the average driver. Plug-in hybrids combine the fuel efficiency of an electric vehicle with the convenience of a regular car. These new hybrids run on electricity, but they also have a gas engine for when you run out of juice and can’t stop to charge.

Although upgrading your vehicle may seem a bit extreme, it can save you a lot on gas. And if you’ve been thinking of purchasing a new car anyway, now is a great time to invest in a fuel-efficient vehicle.

Related: 10 Proven Ways to Save Electricity at Home

7. Carpool

If getting a new vehicle isn’t feasible right now, consider cutting back on how much you drive. For most drivers, the commute to work is where we regularly use the most gas. Carpooling to work is an easy way to reduce your fuel spending. Sharing rides to work saves both you and your coworker money at the pump.

Carpooling is also great for parents. If you’re spending too much money filling up the car to take your kids to school or soccer practice, see if other parents want to split the costs. By taking turns driving, you’ll each get a nice break from the kids and you’ll save on gas.

8. Use public transportation

Public transportation is better in some cities than in others. But if your city offers reliable public transportation, it can be a great way to save money. Bus or subway passes are usually much cheaper than filling up your gas tank. Nobody is suggesting you get rid of your car completely, but by using public transportation a few times a week, you can save big.

9. Ride your bike

If your office is close to home, consider riding your bike to work instead of driving. Many cities are focusing on becoming more bike-friendly, adding bike lanes and paths to make it easier for cyclists to get around.

Bike sharing programs are also gaining popularity. These programs allow you to rent a bike from a station, then drop it off at another station when you’re done. If your city has a bike rental program, it’s even easier to start biking instead of driving.

Besides saving money on gas, riding your bike around has tons of other benefits. You don’t have to worry about parking, for one. And when you bike to work, you’re getting your daily dose of cardio along with your morning commute.

Save Money in Other Areas to Put Towards Gas

If filling up your vehicle is breaking the bank, look for ways to save money in other areas. The more you save, the more you’ll have left over to fill up the tank. Like the old saying goes, “A penny saved is a penny earned.” Use these tips to save money and stop emptying your wallet at the pump.

Use a tool to measure spending

The first step to saving money is to figure out where you’re spending money. By tracking your spending, you can see where you need to cut back. These tools will help you measure spending, create a budget, and stick to it.

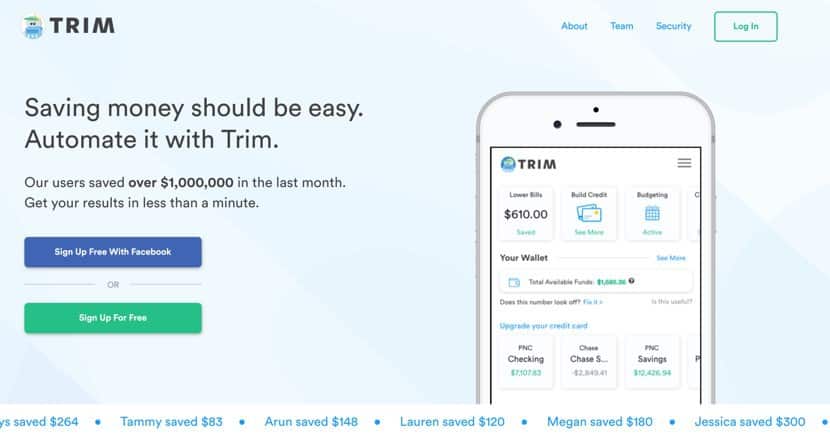

9. Trim

The best part of Trim is that it can actually lower your bills. Once the app shows you all the subscriptions you spend money on, you pick the ones you want to cancel and Trim does it for you. Trim also has new features that identify which bills are abnormally high, then negotiates them down for you.

10. Mint

Mint has become the go-to app for anyone looking to track their spending. Mint connects to your bank account and categorizes spending for you, so you can see at a glance how much you’re spending on groceries, shopping, or gas. You can then set up a budget for each category to help you reign in unnecessary spending.

Although Mint won’t save you any money by itself, it can help you keep tabs on expenses and know when you’re overspending. When you get close to your budget for the month in any category, Mint will alert you. Plus, you can log on anytime and see how much you’ve spent. The best part is that Mint is completely free to use, so there’s literally no risk.

11. You Need A Budget

You Need A Budget began as a method for saving money by breaking down expenses into different categories. Today, the company might be best known for its software, which helps users create and stick to a budget. Unlike Mint, You Need A Budget (or YNAB, for short) does more than just show you how much you’ve spent. It gives suggestions and walks you through the YNAB system for saving money.

The downside is that YNAB isn’t free. You get a 34-day free trial, but after that you’ll pay $6.99 per month. The company claims most users save far more than this, and the free trial period should help you figure out if the program is worth it.

Use mobile cash back shopping apps for fuel cards

We’ve already discussed how you can get fuel rewards by shopping at certain grocery stores; but that’s not the only way to get rewards for shopping. There are some great rewards programs and apps that will give you cash back just for buying things you would anyway.

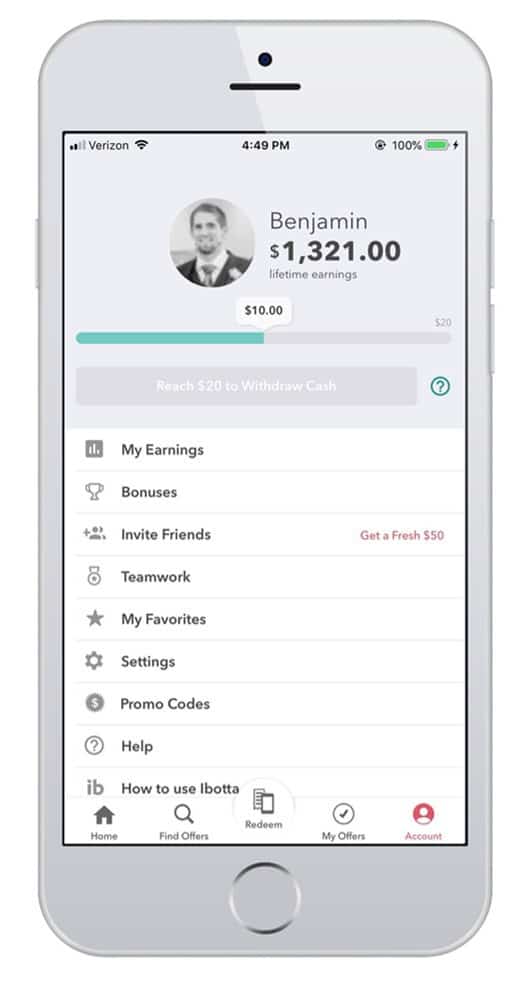

12. Ibotta

Most of the deals on Ibotta will only save you money on brand name goods, but there are some exceptions. There’s almost always a $0.25 “Any Item” rebate, so you’re practically guaranteed to save on every trip. The app also regularly offers deals on “Any Brand” items, allowing you to save extra by buying the cheapest brands and still getting money back.

Related: DollarSprout’s Ibotta Review

13. Rakuten

If you do a lot of online shopping, you need to start using Rakuten. Rakuten (formerly Ebates) gives you cash back for shopping at tons of stores, including big names like Walmart, Macy’s, and Nike. The amount you earn varies depending on the store, but there are plenty of deals up to 9% cash back.

To get your rebate, all you have to do is follow the link to your chosen retailer on the Rakuten site when you go to shop. Rakuten does the rest automatically. You’ll get your cash back as a check or free PayPal cash every 3 months. With the right deals, that money could easily fill up your gas tank for free.

Read our full Rakuten review here.