21 Best Passive Income Ideas to Make Extra Money (2025)

Our readers always come first

The content on DollarSprout includes links to our advertising partners. When you read our content and click on one of our partners’ links, and then decide to complete an offer — whether it’s downloading an app, opening an account, or some other action — we may earn a commission from that advertiser, at no extra cost to you.

Our ultimate goal is to educate and inform, not lure you into signing up for certain offers. Compensation from our partners may impact what products we cover and where they appear on the site, but does not have any impact on the objectivity of our reviews or advice.

Making money while you sleep: that’s everyone’s dream, right? By the time you've finished reading this article, you'll have all the passive income ideas you need to start generating residual income and make money 24/7 for yourself.

Our mission at DollarSprout is to help readers improve their financial lives, and we regularly partner with companies that share that same vision. If a purchase or signup is made through one of our Partners’ links, we may receive compensation for the referral. Learn more here.

They say that the average millionaire has seven different streams of income.

But most millionaires don’t have seven different jobs. In many cases, they’ve leveraged the power of passive income to accelerate their wealth building.

And even though it sounds great to kick your feet up on a beach somewhere and watch the money roll in, the reality is that building a steady flow of passive income will usually require a fair bit of effort.

If it was easy, everyone would be doing it, right?

However, if you are up to the challenge, don’t let the promise of a little hard work deter you. There are plenty of reasonable ways to generate passive income that actually work, many you can start today. And even though earning passive income is unlikely to solve all of life’s problems, it’s not a bad place to start — especially if you have the dream of one-day reaching millionaire status.

What Is Passive Income?

Passive income, also known as residual income, is money you earn while you’re not actively working. Instead of trading your time for money — like most people do at their 9 to 5 jobs — passive income is all about having money trickle in even while you’re not actively working.

Some examples of passive income include investing in the stock market, real estate, and even the income generated from an online business venture.

The Two Approaches to Generating Passive Income

Passive income doesn’t magically drop from the sky. It is generated from existing assets. And no matter what those income-generating assets are, there are only two ways to build them:

Approach 1: Invest money

If you are sitting on a bunch of idle cash, you can put that cash directly into an investment. These types of passive income streams usually require minimal effort. Think of them as a way to “put your money to work” to generate returns for you in the background.

Examples:

- Open a high-yield savings account

- Invest in alternative asset classes

- Rent out your basement, attic, or garage

- Earn cashback on everyday purchases

- Invest in crowdfunded real estate

- Start investing with a robo-advisor

- Buy your first investment property

- Invest in dividend-paying stocks

- Peer-to-peer lending

- Build a CD ladder

- Buy an already-profitable blog

Approach 2: Invest time & effort

If you don’t have a lot of extra cash on hand, you will need to manually work toward building your passive income asset. There may still be some monetary costs involved, but the bulk of your investment will be time and effort. The long term rewards may be higher.

Examples:

- Referral marketing

- Affiliate marketing

- Start a YouTube channel

- Start an advertising agency

- Create and sell an online course

- Build an e-commerce website

- Sell stock photography online

- Put your car to work for you

- Write an e-book

- Sell your location data

What’s the difference between passive and active income?

Active income involves earning money in exchange for a service. It could be a salary, an hourly wage, commissions, or tips. It’s essentially a trade of your time for a fixed dollar amount.

Most people choose to earn their living this way, and there’s nothing inherently wrong with that, as long as you understand that there will be a limit to how much money you can realistically earn. That’s not to say you should quit your job (at least not yet), but if you’re looking for creative ways to start generating wealth, here are 19 ways to make passive income.

Passive Income Streams That Require Cash

If you have extra money that you want to put to work, here are 10 passive income ideas to consider.

1. Open a high-yield savings account

If you have a traditional savings account, chances are good that the interest rate your money is earning is virtually non-existent. In fact, the national average APY for savings accounts is right around 0.42% — not enough for you to see any meaningful income. Luckily, online banks have burst onto the scene with some really enticing interest rates. Higher interest = more money you make off your savings.

Why are interest rates so much higher for online savings accounts vs. regular brick-and-mortar banks? One word: overhead. By not having physical branches (and all the things that come with branches like tellers, rent, utilities, etc.), online banks are able to pay their customers much higher interest rates.

CIT Bank (Savings Connect) and Axos Bank (Axos ONE) are leading the charge when it comes to offering high-interest yields — in the neighborhood of 8 to 9 times the national average.

In the past, if someone wanted to capture a guaranteed two-plus percent return on their money, they could often only get those types of returns with a certificate of deposit (CD). The drawback with that approach is that the money is tied up for the term of the CD. Highly-rated savings accounts, on the other hand, allow for much easier access to your money if you need it.

2. Invest in alternative asset classes

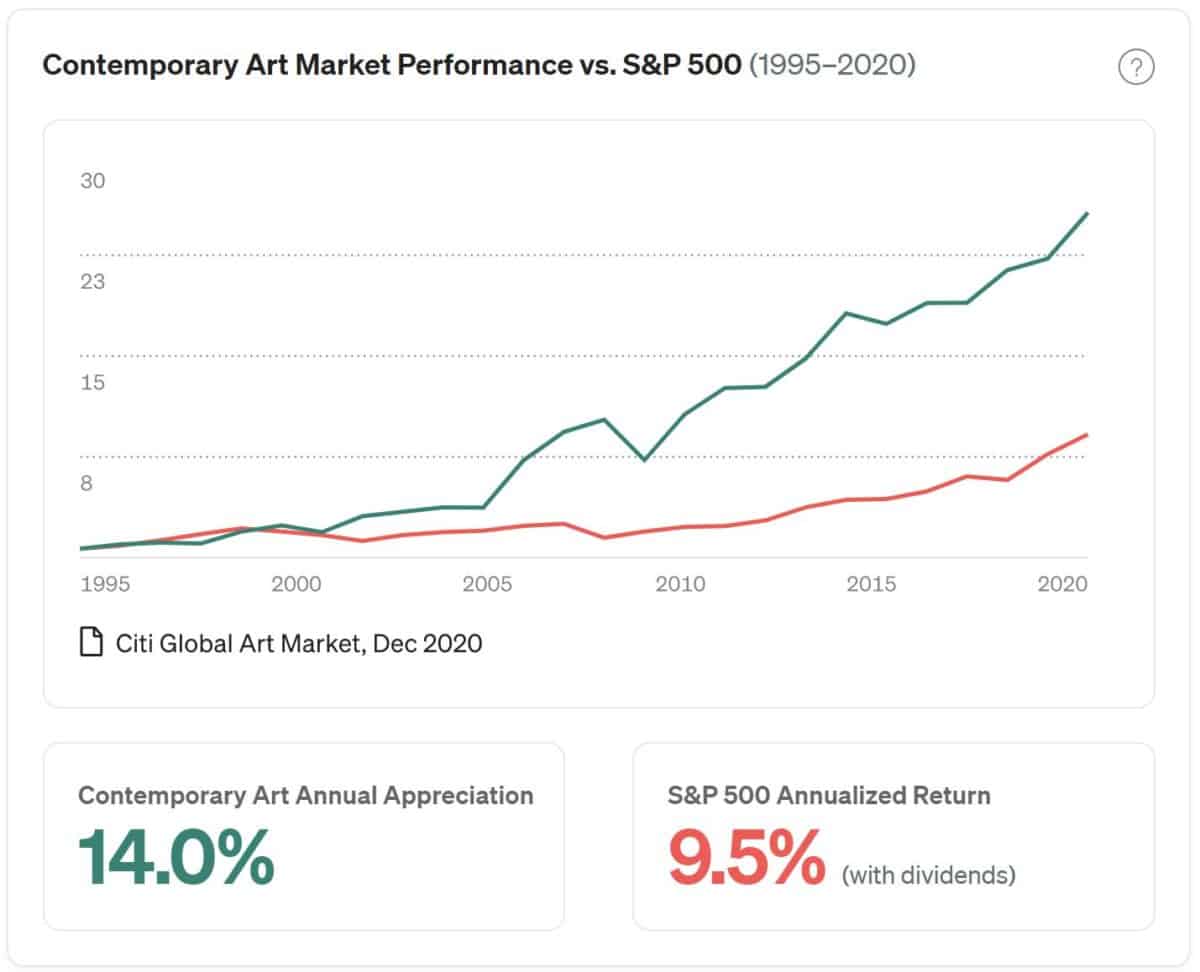

Crypto is all the rage right now, but if your appetite for risk resides somewhere below the moon, investing in fine art is a realistic way to try to outpace the gains the stock market has offered over the past thirty years.

Now, past gains aren’t necessarily indicative of future performance, but adding another asset class to diversify your portfolio — especially one that has performed as well as fine art — can be a good way to hedge against overvalued equity markets.

Companies such as Masterworks offer a platform for investing fine art without having to acquire — or protect — million-dollar paintings on your own. Much like a mutual fund, you can invest for the long haul and receive proceeds (dividends) when certain works of art sell.

Related: How This Artist Earns $5K+ a Month Licensing Her Artwork

3. Rent out your basement, attic, or garage

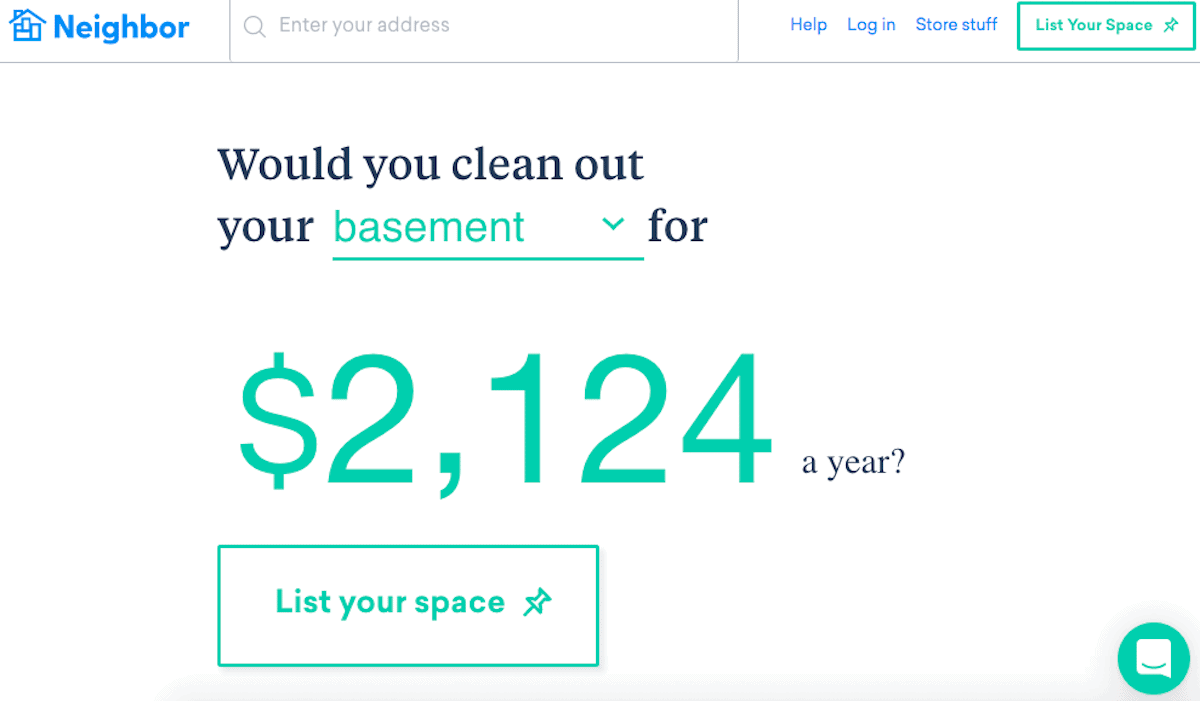

If you’re a homeowner, renting out space on your property can be a great way to earn (mostly) passive income. With Neighbor.com, you can rent out any space you own or have permission to rent, including (but not limited to) your:

- Garage

- Bedroom

- Closet

- RV pad

- Basement

- Warehouse

- Office space

- Empty lot

- Shed

Neighbor provides a recommended price range based on other listings in your area, but you get to set your own rates. Users will ask to book your space through the app. You can review each candidate’s profile and message them for more information on what they want to store before accepting the listing.

It’s up to the renter to cancel the agreement. So if you find someone who needs long-term storage, you can earn passive income each month they store with you. As a host, you’ll be protected by Neighbor’s $1M general liability insurance policy. Neighbor guarantees automatic payment on its part, so you’ll still receive payment even if your renter stops paying.

Try Neighbor’s income estimator to see how much you could make renting space in your home.

Related: How One Man Makes $1,200/mo Renting Out a Vacant Lot

4. Start earning cashback

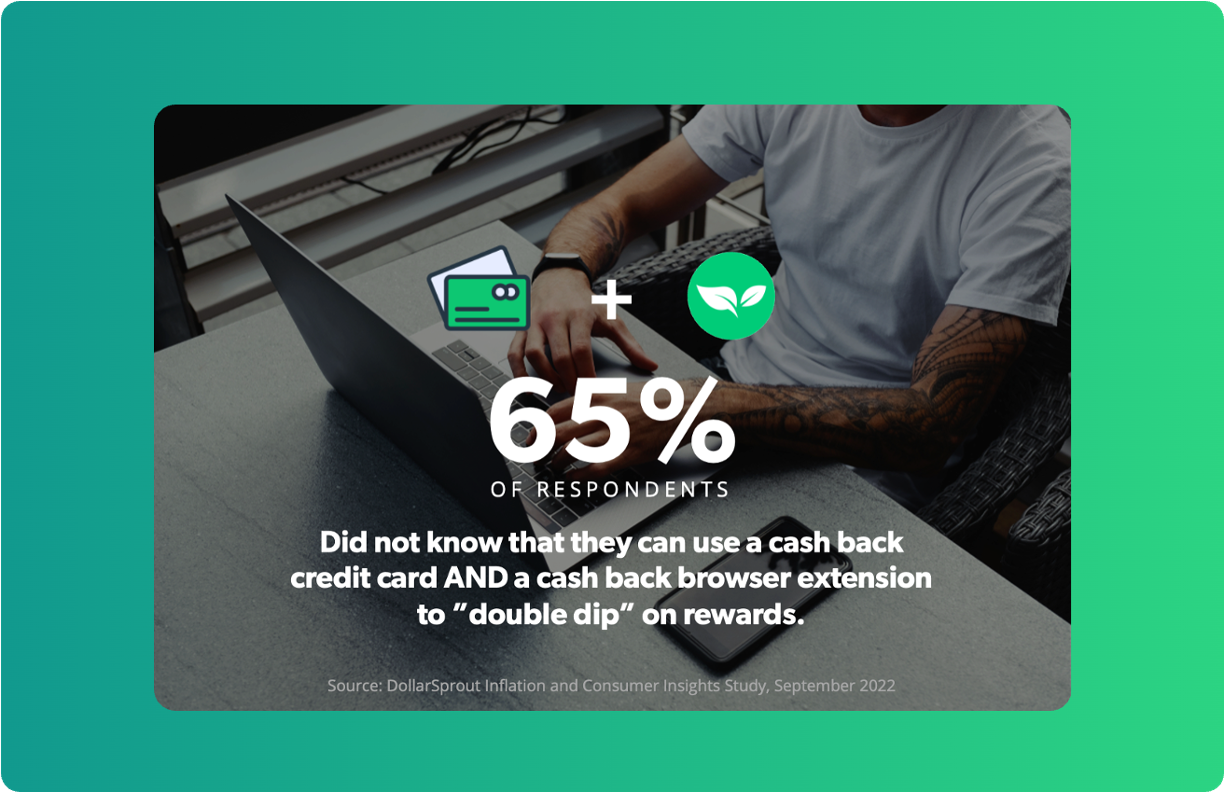

If you already do a portion of your shopping online, you could be missing out on some easy passive income by not taking advantage of cashback rewards.

Strategy #1: Cashback credit cards

Cashback credit cards offer a percentage — typically 1-5% — on purchases you already make. Some cashback offers vary depending on the category. For example, a card may offer 2% cashback on gas and groceries and 1% on all other purchases.

Many cashback credit cards also offer sign-up bonuses. For these programs, you’ll usually need to spend a set amount within the first 60 to 90 days of opening your account in order to qualify for the bonus. But, keep in mind these offers are only beneficial if you pay off your credit card balance every month. Interest fees can add up quickly and easily negate any potential rewards.

If you already have a cashback card you love or prefer not to open a new credit account, there are other options to earn rewards for your everyday purchases.

Strategy #2: Cashback apps or extensions

For even more savings, use cashback extensions or apps that automatically apply coupon codes and reward you for shopping through their links. These tools work behind the scenes while you browse, alerting you to any available cash-back offers or discounts.

Whether you’re shopping at Walmart, Target, or your favorite clothing store, pairing a cashback app with a rewards credit card can help you double dip on your savings with minimal effort.

Related: 13 Best Cashback Apps for Saving Money on Every Purchase

5. Invest in crowdfunded real estate

Many people consider investing in real estate to be the ultimate form of passive income. In an ideal world, you can own a piece of property that generates income via rents and appreciates in value over time, therefore producing excellent returns. The problem is, traditionally, you often need a lot of upfront capital to get started.

Nowadays, there’s a way to invest in real estate while not dropping hundreds of thousands of dollars on a single property. A real estate investment trust (REIT), for example, is a pool of money from many investors that is managed by professional real estate investors. The money in the pool goes toward investing in real estate. Investors put money into the REIT, the REIT buys properties, and the returns are disbursed back to investors.

The best part is that you don’t have to worry about handling the landlord duties — it’s an income stream that is truly passive. Most REITs still require a hefty investment to get in, but with Fundrise, you can get access to dozens of solid, value-producing assets for as few as $500 to start. All-in-all, it’s an easy way to diversify your investments and get exposure to a market that may have been previously inaccessible.

*This is an endorsement made in partnership with Fundrise. While we do earn a commission from partner links on DollarSprout, our opinions and judgments are our own.

6. Start investing with a robo-advisor

Investing is often considered a cornerstone component of any wealth-building strategy. Previously, having your investments managed by a financial professional was only available to the wealthy. It was just too expensive for the everyday person to get started.

Fast forward to now, and technology has made investing more accessible for everyone. Instead of relying on a single human to manage your investments, robo-advisors (a.k.a. sophisticated computer programs) take care of all the work for you — even if you are new to investing and only have a small amount of money to start with.

Betterment is one such robo-advisor that gives you an individualized, professionally built portfolio. All you have to do is tell it a bit about yourself and your long term investment objectives, fund your account, and it takes care of the rest.

To compare further, see our top-rated investment apps.

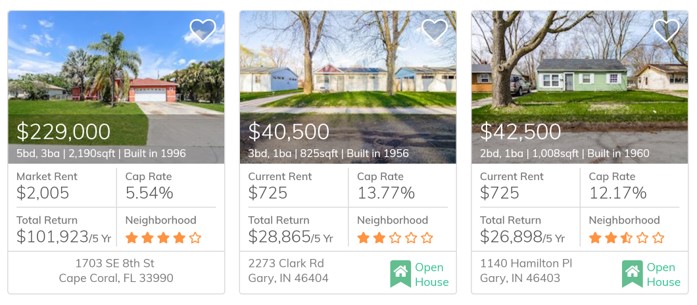

7. Buy your first investment property

Unlike Fundrise, Roofstock isn’t a real estate investment trust, which means you’ll be buying individual properties.

This is an ideal strategy if you live in an area where real estate prices are too high to realistically invest in, or you don’t want the hassle and expense of traveling all over the country visiting potential properties. Plus, if you are new to single-family real estate investing, letting a place like Roofstock guide you through the process is a great way to get your feet wet.

Once you buy the property, it’ll pair you up with one of its vetted property managers to deal with the day-to-day “landlord” tasks like collecting rent and scheduling maintenance.

Another option: Consider starting your own real estate investment group. This is a great way to team together with other small investors, either via pooling your money together or simply by learning from each other. According to Joseph Hogue, CFA, “The common bond in all real estate investing groups is that you help each other compete against the big money players to get the best returns.”

8. Invest in dividend-paying stocks

Even though it’s one of the oldest and least sexy of passive income strategies, there is something to be said about investing in stocks that pay quarterly dividends. This is one of the best ways to easily generate passive cash flow without much work.

As the old saying goes, when you buy stocks, you do it with the hopes of “buying low and selling high.” Dividend stocks work the same way, but with one other benefit: just for owning the stock, you are paid a small portion of the company’s earnings in the form of a dividend. With these types of stocks, you get paid when the stock goes up in value, and when dividends are paid out.

Let’s say you buy shares of Colgate-Palmolive stock. Not only is the stock price likely to rise over time, but you’ll also get paid for each share of stock you own. Over the past seven years, Colgate-Palmolive has paid between $0.34 and $0.68 each quarter for every single share owned by stockholders.

9. Peer-to-peer lending

Peer-to-peer lending, also called “P2P lending”, is a relatively new way for people to lend and borrow money. The system works by creating a marketplace that brings together people with money and people who need money. It connects them and allows borrowers to loan cash to peers (hence the name) and earn a return on that investment, just as a traditional bank or lending institution would.

Imagine lending a friend $10 and them promising to repay you $11. Your friend gets the money he needs and you earn a 10% return — assuming they pay you back. Now, imagine this on a much larger scale, with thousands of individuals lending and borrowing money from one another. That’s how peer-to-peer lending works.

Proponents of P2P lending tout its upsides and draw attention to the fact that it is democratizing the loan industry. It allows individuals to gain access to credit that they may not otherwise have qualified for and at the same time allows people with disposable income to earn a return on their money.

One of the most popular P2P lending platforms, Lending Club, lets investors compare loan details such as grade or subgrade, loan purpose, interest rate, and borrower information. Here are the 12 types of loans that you can invest in with Lending Club:

- Credit card refinancing

- Debt consolidation

- Home improvement

- Major purchase

- Home buying

- Car financing

- Green loan

- Business loan

- Vacation

- Moving and relocation

- Medical expenses

- Other types of loan

Other peer-to-peer lending platforms include Prosper and StreetShares.

10. Build a CD ladder

A CD ladder is a great way to maximize the interest rates you earn on your savings without tying your money up for long periods of time. This is accomplished by staggering several different CDs so they all mature at different times. The purpose of a CD ladder is to keep your money liquid (or available to withdraw) like with a savings account while earning the higher interest rates that usually come with CDs.

To create a CD ladder, the first step is to choose a bank with high interest rates on its CDs. Let’s say you find a bank that offers the following CDs:

- 6-month CD at 1% interest

- 12-month CD at 2% interest

- 18-month CD at 3% interest

You decide to buy one of each. After six months, your first CD matures and you decide to renew it. You buy an 18-month CD with the money. When the 12-month CD matures six months later, you buy another 18-month CD. This creates a CD ladder where you get access to funds every six months. This means that every six months, you’ll decide whether to open a new CD or withdraw the money plus the interest you earned.

A CD ladder that “matures” every six months is better than putting all of your money in an 18-month CD because you don’t have to actually wait 18 months to claim your money. You may sacrifice a small amount of interest, but the flexibility is nice to have. You want to avoid early cash-out penalties at all costs.

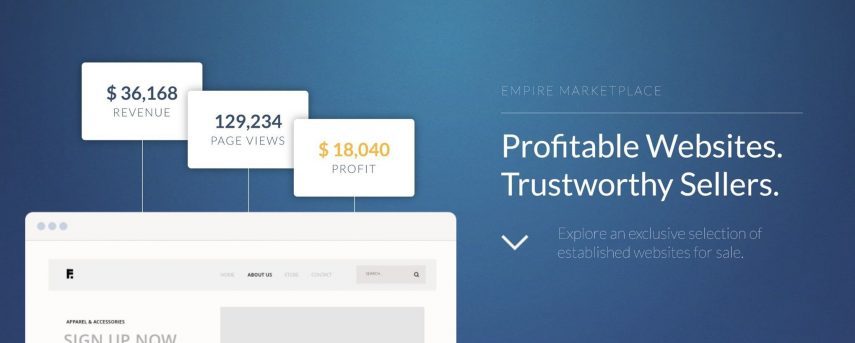

11. Buy an already-profitable digital business

If you’d prefer to skip the startup phase of getting a business off the ground, you might want to buy a blog that’s already built and earning revenue. This is actually pretty easy to do as a lot of people start blogs, and then get bored with them. Getting a blog going is a labor-intensive process, and it’s not uncommon for people to give up before they’ve reached their full potential.

Two popular marketplaces for browsing available blogs to purchase are Flippa and Empire Flippers.

Empire Flippers tends to have more well-established and profitable websites and blogs for sales. Expect to see prices ranging from above $20,000 to over $2 million. However, most of them have multiple revenue sources, so the advantage is you’re taking over a site that will bring in cash from day one.

Flippa’s inventory is not nearly as prestigious, but you might find some hidden gems. It’s an auction-style format, so you bid on the site you’re interested in. Bidding starts as low as $1, and if you get lucky, you may end up with a pre-built blog for less than $1,000!

One word of caution here: If you do decide to buy a blog, you should at least have some experience in running an online business. It’s not recommended that you blindly jump into this one.

Passive Income Ideas That Require Time & Effort Investment

If you are ready to roll your sleeves up and get to work, the ideas in this section can eventually lead to a steady flow of passive income – and can maybe even surpass your day job income at some point. There may still be some monetary costs involved, but the bulk of your investment will be time and effort.

12. Referral marketing

It’s no secret that companies are willing to pay influencers big money to help them tap into new markets. One-time payments frequently range from $5 to $500 or more depending on the product, app, or service.

While those programs are certainly appreciated, especially if you have a lot of family or friends, or are even fortunate enough to have your own audience of fans, its revenue share referral models where the big bucks lie. Sites like Freecash.com — a popular get-paid-to (GPT) site where readers participate in ways to make money online — have one such model.

It exists in tiers, but members can refer other users to the site and collect a portion of their earnings in perpetuity. The first tier starts at just 5%, but the tiers are easily achievable, and members can quickly earn anywhere from 10% to 30% of all their referred users’ earnings.

Popular ways to recruit members using your link include creating video content (think YouTube, TikTok, Reels), writing site reviews on Reddit or Quora, or by sharing valuable insights about the get-paid-to platform on social media sites like X (formerly Twitter).

13. Affiliate marketing with a blog

Affiliate marketing is a way to make money by promoting other people’s (or company’s) products and services and earning a commission for each sale you generate.

Let’s say that you want to earn a commission when someone buys a mattress online. Since most mattress companies pay a 5% commission and the average price of a decent quality bed sold on the Internet is about $1,000, you would make $50 every time someone bought a bed based on your recommendation.

Sounds good in theory, right? But how do you actually get started?

One of the best ways to get started is to launch your own blog. A blog is your very own website where you can write about whatever you’d like. The most successful bloggers and affiliate marketers usually stick to a specific niche or topic. Going back to the mattress example, someone who blogs about sleep (sleep habits, sleep hygiene, tips, tricks, etc.) would be a great affiliate for mattress companies. On the other hand, a sleep blogger would probably not be successful if they tried to sell basketballs on their blog.

Furthermore, having a blog opens you up to all sorts of other revenue streams. Not only can you earn passive income online with affiliate commissions, but you can also make money on advertising, too. One of the most appealing parts about blogging is that it is quite scaleable — it’s not uncommon to earn residual income from posts that are several years old. As long as people are reading your content, there is an opportunity to earn income.

14. Start a YouTube channel

So, the rules on making money with a YouTube channel changed in January 2018, but this is still an option. You’ll just need to adjust your strategy slightly.

It used to be that almost anyone could monetize a YouTube channel. What this means is that you allow advertisers to place videos (i.e. ads) at the start of your content. When you get a certain number of views, you earn cash.

Popular topics include makeup tutorials, travel guides, unboxing videos, or anything you can think of, really. Because YouTube is such a popular platform, there are more than enough eyeballs to attract an audience to even the most obscure niche.

15. Start an online advertising agency

Think about how many small businesses are in your city. Chances are, most of them are not effectively using social media to attract more clients or drive more sales to their business. Most will have a regular Facebook page, for example, but that’s not enough to spread the word in today’s crowded newsfeed.

That’s where you can come in as a Facebook Ad agency owner. One of the best parts of this business model is that once you have a client’s advertising campaigns up and running smoothly, there is very little ongoing work needed on your end. Outside of checking in for a few minutes each day, it’s a relatively hands-off business model.

Even with very little experience, learning the art and skill of Facebook ads is doable. Almost anyone can pick it up and land their first client within a month.

Most Facebook ad agencies — even one-man operations —& will usually charge a flat monthly retainer in the neighborhood of $1,000 – $2,000 per monthper client. This is in addition to the money spent on the ads themselves, which goes directly to Facebook.

As you bring on more clients and build a reputation in your area, your income can quickly increase. At that point, you can hire an assistant to make your business run as passively as possible.

16. Create and sell an online course

Maybe you’re especially knowledgeable about a topic. You can create an online course teaching anything from algebra to guitar and launch it on a platform like Coursera or Teachable. The beauty of this strategy is that once you do the initial work of creating the course, you continue to get paid for each new student that enrolls.

So, which platform should you choose?

Coursera and Teachable are two of many, but these are the most prevalent, and they’re both intuitive and user-friendly. With Teachable, you have more control over your pricing and the look and feel of your course, but you don’t get a built-in audience. Instead, you have to do all the marketing yourself. Coursera has a built-in base of students, but you don’t have as much control and it takes more of your revenue.

-

- Create a course for free: All you need is an email address to get started.

- Upload your content: Seamlessly upload videos, audio, presentations, images, and text.

- Make it your own: Customize your school with your brand, colors, logos, etc.

- Launch: Attract students and sell your online courses.

Related: 19 Digital Product Ideas to Make and Sell Online

17. Build an e-commerce site

Most e-commerce sites are a lot of work to properly set up. However, once you find a system that works, maintaining that system can be relatively passive. Here are the main types of e-commerce sites that are most popular:

Sell your own product: you either manufacture or source your own product(s).

Pros: You have ultimate control and you get the highest profit margin.

Cons: It’s a lot of work and often requires significant capital.

Sell other people’s products: source goods from one or a variety of companies.

Pros: You get a wide variety of products at wholesale prices.

Cons: Lots of work and difficult to compete on price. Also, it can be difficult to differentiate yourself.

Dropship: when a customer orders from your site, the manufacturer ships.

Pros: You don’t have to handle physical inventory and there is less work involved than the models discussed above.

Cons: Margins aren’t great, you don’t have control over the quality, fulfillment, and the customer journey.

Related: How to Start Your Own Dropshipping Business

18. Sell your photos online

Ever wondered how you can get paid to take pictures? As it turns out, it’s actually pretty simple.

One of the best sites to make money with your photos is Shutterstock. Since its inception in 2003, Shutterstock has paid out over $500 million to its contributors. Due to its popularity and low barriers to entry, this site can work as a passive income source regardless of your experience level.

Set up an account, upload your images, and earn money every time a customer downloads your photos. The amount you earn per download depends on the type of customer who purchases the image. If a customer with a monthly subscription downloads your image, you’ll earn less than a customer who pays specifically for your photo.

The more you earn over time, the more you can earn for each image.

Related: How One Photographer’s Side Hustle Became a $330K a Year Business

19. Put your car to work for you

Think of how often your car sits around not being used – while you’re traveling, on vacation, or even during your typical workday.

You have two options: 1) let your car sit around and depreciate, or 2) use it to earn some passive income.

Rent out your car with Getaround

With Getaround, you can potentially earn thousands of dollars per year by renting your car to others while you’re not using it. The average annual cost of owning a car is almost $9,000.[1] By renting your car with Getaround, you can make some (if not all) of that money back.

As a Getaround car owner, you get dedicated parking at the best spots in town, a $50 monthly driving credit to rent whatever you like, and $1 million in primary insurance coverage.

Your rental earnings accrue monthly with payments sent on the 15th of the following month.

Advertise with Wrapify

Wrapify is an app that pays you to advertise brands and businesses on your car. According to its website, drivers can make $400+ per month.

In order to get started, you’ll need to download the app and track your driving. Once you meet the minimum qualifications, you’ll be notified when a campaign is available in your area.

Related: 9 Ways to Earn Passive Income With Your Car

Rent your RV with RVShare

RVShare lets RV owners rent their unused RVs to travelers. All you need to do to get started is register with the site, create a free listing for your RV, and respond to booking inquiries.

How much you can earn depends on the season, the kind of RV you’re listing, and how long the rentals last. However, the site states that owners can make up to $40,000 per year renting out their RV through the site.

Related: We’ve Earned $100K Renting Out Our Pool on Swimply — Here’s How

20. Write an eBook

If you like the idea of writing, but don’t want to deal with the technical headache that can come with blogging, consider self-publishing your own eBook. EBooks are often much shorter than normal books, which makes them easier to write and sell.

The most successful eBooks are usually non-fiction. Think how-to guides and other explanatory pieces on a certain topic, like fitness or graphic design.

Amazon Kindle Direct Publishing is probably the easiest platform to get started on. Publishing takes just a few minutes and most books appear on Kindle stores worldwide within 1-2 days. With Amazon KDP, you can earn up to 70% royalties for each sale to customers in most countries, and you can set your own prices and make changes to your books at any time.

21. Sell your location data

This is the only item on this list that requires no effort and no money—just install Pogo and let it run. The app passively collects anonymized location and purchase data, similar to what most big tech apps already track for free. The difference? Pogo actually pays you for it.

Earning with Pogo is simple. Download the app, grant location permissions, and that’s it. The data it collects is completely anonymous—companies that purchase the insights don’t see personal details, just patterns that help them understand consumer behavior, like where people shop and how often they visit certain places.

In my experience, I make around $10 a year just by keeping the app installed. Not a fortune, but considering I put in zero effort, I’ll take the free money. Pogo also offers surveys and cash-back deals if you want to earn more, but they’re totally optional.

If your phone is already tracking you anyway, Pogo makes sure you actually get something for it.

How to Pick the Best Passive Income Stream for You

Ultimately, you can pick a combination of these passive income ideas or try them all.

The right path for you will depend on your short- and long-term goals, how much time you have, how much money you want to earn, and how many hours of work you’re willing to put in.

Real estate is a path that many experts recommend. Investor Louis Glickman said: “The best investment on earth is earth.” And, of course, there are stats touting that 90% of all millionaires gained that status by owning real estate.

And while real estate is an excellent option, it does require a significant initial investment. Whether or not this passive income stream is right for you depends on your current financial situation. You might be better off starting with an investment strategy where you can build funds until you have a big enough sum to get involved in real estate.

Some people will be more drawn to the passive income ideas that they get to control. Many entrepreneurs love the idea of creating something, whether it’s a blog, a YouTube channel, a course, or a store. And while it’s technically not passive in the beginning, it can be a life-changing experience and one that brings enormous wealth and satisfaction.

Related: How This College Student Built a $500K Vending Machine Business