How to Invest $100 for Maximum Return

Our readers always come first

The content on DollarSprout includes links to our advertising partners. When you read our content and click on one of our partners’ links, and then decide to complete an offer — whether it’s downloading an app, opening an account, or some other action — we may earn a commission from that advertiser, at no extra cost to you.

Our ultimate goal is to educate and inform, not lure you into signing up for certain offers. Compensation from our partners may impact what products we cover and where they appear on the site, but does not have any impact on the objectivity of our reviews or advice.

You don’t have to be wealthy to start investing. You don’t even have to have a full-time job. In fact, some of the best investments you can ever make can be done with less than $100.

Our mission at DollarSprout is to help readers improve their financial lives, and we regularly partner with companies that share that same vision. If a purchase or signup is made through one of our Partners’ links, we may receive compensation for the referral. Learn more here.

Picture this:

You’re caught up on bills, your fridge is stocked for the first time in a while, and you find yourself with an extra $100 left over at the end of the month. It feels good to finally get ahead, even if it’s just a little bit.

But now it’s time to turn a small win into a big win. Instead of spending what’s left on random stuff, you’ve decided you want to use this $100 for something more meaningful.

You want to invest it.

There are lots of ways to invest small amounts of money, but not all opportunities are created equal. Here are some of the best ways to invest your first $100.

12 Best Ways to Invest Your First $100

This list is not going to be a list of hot stocks you should buy. That’s just a glorified form of gambling that you shouldn’t get caught up in.

Instead, these are wise and level-headed things to consider doing with your money.

1. Start investing with an app

If you are set on getting started with investing in the stock market, there are many cheap or even free options to get your feet wet with. Even though apps make it easy to get your money in the market, there are still some basics you need to understand.

Only invest what you can afford to lose. The value of most investments goes up and down every day, so don’t make the mistake of investing money that you need for paying your bills.

Invest for the long term (5+ years, minimum). The daily fluctuations of the market can take an emotional toll on anyone who has money riding on it, which is why it’s important to tune out the noise. Over the long term, the stock market tends to go up. In the short term, it’s anybody’s guess as to what it will do.

Make a habit of regularly depositing and investing. Everything comes back to your habits. Your first $100 might not make a huge difference to your long term returns, but if you deposit $100 a month for a year, you now have $1,200 +/- your investment performance. Most apps allow you to set up automatic recurring deposits; take advantage of it.

If you are a complete beginner to investing and want to dive deeper, check out our how-to guide for investing.

|

$0 per trade |

$1-3 per month |

$0 per trade |

| Designed for DIY investors | Beginner-friendly | Commission free trading |

| Easy-to-use mobile app | Completely automated | Automated rebalancing |

| No account minimum | No account minimum | $100 account minimum |

|

Get 1 free stock |

$10 signup bonus |

No signup bonus |

2. Pay off debt

Paying off debt is an immediate way to capture “returns”, but it’s often the last thing people think about when deciding how they want to invest.

In reality, paying off debt is one of the smartest moves you can make with your money. Here’s how the math works out:

| Scenario 1: Invest $100 in the stock market instead of carrying $100 in credit card debt at 25% interest |

Scenario 2: Pay off $100 in credit card debt that would have otherwise incurred 25% annual interest |

| The value of your investment may go up or down | Your owed balance instantly goes down and you stop accruing interest |

| 1 year from now, you may have $110, $100, or you may even lose money and have only $90 | If you hadn’t paid this off, you would have paid ~$25 in interest over the course of a year |

| Even with a 10% return that grows your balance to $110, your credit card debt hasn’t gone away. You will still owe ~ $25 in credit card interest. | By paying off the debt, you immediately captured more money for yourself via avoiding interest. |

| $10 investing profits – $25 credit card interest

= net loss of $15 |

$0 investing profits + $25 in interest payments that you never had to make

= $25 more to your name after one year |

This is why it’s almost always better to target high-interest debt before you start investing money into the stock market.

“Credit cards are the worst investment that you can make,” is the message billionaire Shark Tank investor Mark Cuban wants people to understand. “The money I save on interest by not having debt is better than any returns I could possibly get by investing that money in the stock market.”

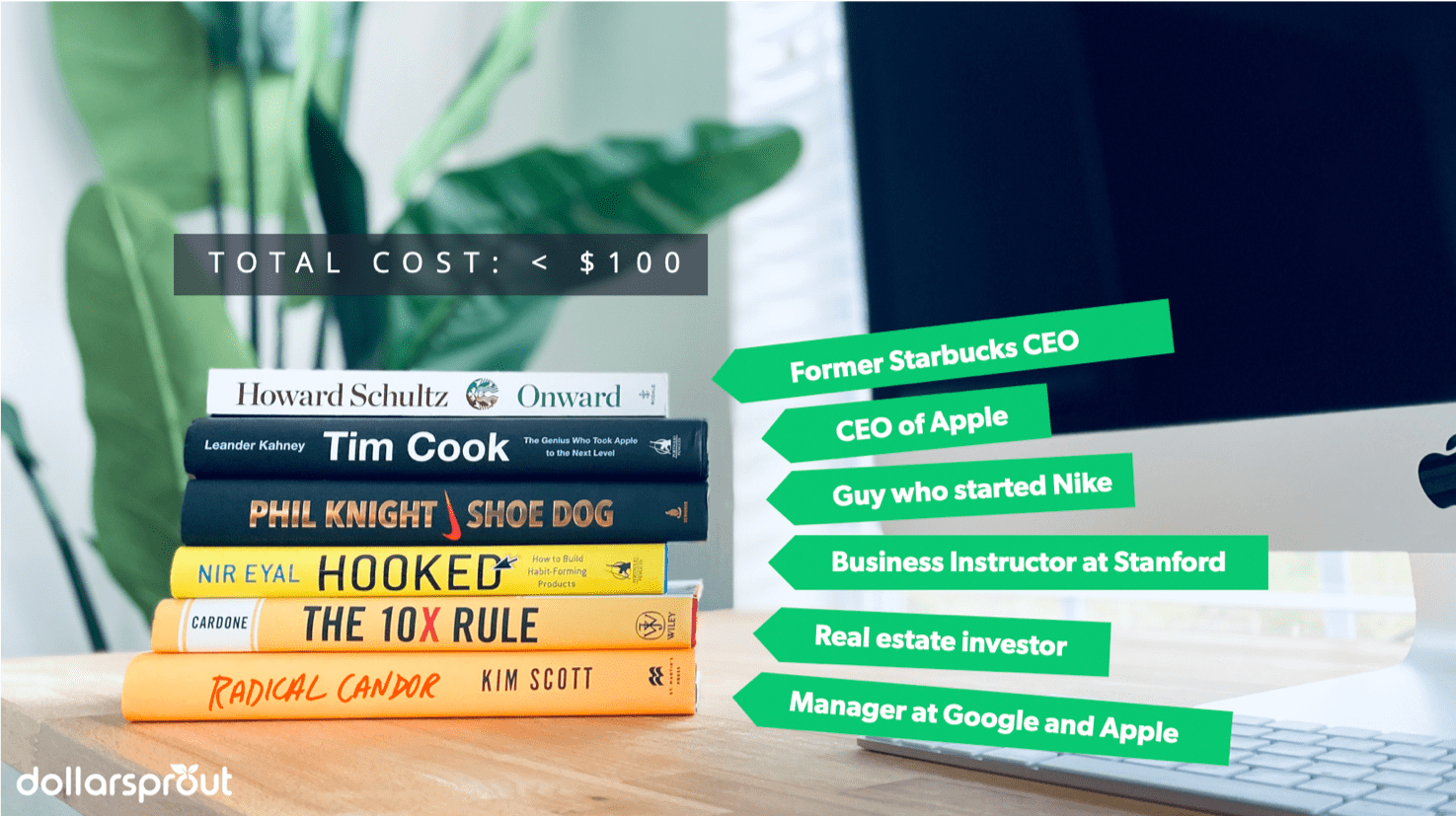

[su_testimonial name=”Mark Cuban” photo=”https://dollarsprout.com/wp-content/uploads/2020/04/Mark-Cuban.png” company=”Shark Tank investor”] I thought I would be a stock market genius; until I wasn’t. I should have paid off my credit cards every 30 days. [/su_testimonial]3. Buy $100 worth of non-fiction books

Because of the fast paced world that we now live in, it feels like books have taken the backseat in most peoples’ lives. Attention spans are getting shorter and shorter and many people simply have no interest in reading something longer than a Facebook status or a tweet anymore (and even this blog post is stretching it).

If you want to break away from the majority, pick up a book.

Books offer some of the highest return on investment (ROI) out of almost anything you can buy. Exposure to new ideas can change your life.

Take autobiographies written by entrepreneurs, for example:

A successful entrepreneur that has already built a thriving business, taken their own lumps on the way to the top, and has a perspective that most people do not. And when someone like that decides to sit down and share their story and condense their knowledge into one book that you can buy for fewer than $20, you better take advantage of that opportunity.

Consider this: If you find even one thing in a book that can improve your life, chances are good that the price tag of the book becomes a drop in the bucket compared to the changes in your life that a piece of knowledge or inspiration might bring.

For example:

[su_panel]

This is a snippet of Kim Scott sharing a story in her book Radical Candor about an interaction she had with Sheryl Sandberg at Google (Sandberg is now the Chief Operating Officer at Facebook). The rest of that story taught me how it is okay to give “harsh” feedback to someone as long as you also show them how you truly care about them and want to help them improve. As a business owner, this has helped me countless times.

[/su_panel] [su_panel]

This a quote from the beginning chapter in Ramit Sethi’s book I Will Teach You to Be Rich. Sometimes we just need to hear the truth.

[/su_panel]$100 Business/Entrepreneurship Bundle

- Onward — by Howard Schultz (Starbucks CEO)

- 10X Rule — by Grant Cardone

- Shoe Dog — by Phil Knight (Started Nike)

- Tim Cook — by Leander Kahney

- Radical Candor — by Kim Scott

- Hooked — by Nir Ehal

$100 Personal Finance Bundle

- I Will Teach You to Be Rich — by Ramit Sethi

- You Need a Budget — by Jesse Mecham

- The Intelligent Investor — by Benjamin Graham

- Get Money — by Kristin Wong

- Broke Millennial — by Erin Lowry

4. Invest $100 in an online course

If you can’t bring yourself to sit down for 30 minutes a day and read a book, taking an online course is probably the next best thing you can do for your own growth.

Being taught skills that you want — from experts that have those skills — can have a very high ROI; especially when you consider how inexpensive online courses are compared to traditional college classes.

Unsure of where to start? I recently signed up for a site called MasterClass; an up-and-coming online course platform has been coined by some as being the “Netflix of self-education.” MasterClass has dozens of courses from world-renowned experts in a variety of specialties. The video production quality of the courses is impressive; you won’t be bored in these classes.

My favorite class so far has been “The Art of Negotiation” by Chriss Voss, a former FBI hostage negotiator (see trailer below). I don’t plan on freeing hostages anytime soon, but there are many practical applications from the teachings in Chris’s course.

Other courses that made MasterClass a great investment:

- Business Leadership by Howard Shultz (former Starbucks CEO)

- Self Made Entrepreneurship by Sara Blakey (founder of Spanx)

- Business Strategy and Leadership by Bob Iger (Disney CEO)

- The Art of Magic by Penn and Teller

5. Open an IRA

Most young people don’t want to think about the day when they aren’t “young” anymore. Nonetheless, saving for retirement is an important part of life. The biggest mistake that most people make when it comes to saving for retirement is not starting sooner. It’s normal to want to wait until you are “better off” before you start putting money away for retirement. It’s up to you to fight that urge to wait and instead just start saving now.

Individual Retirement Accounts, or IRAs, come with special tax advantages that are meant to encourage you to regularly contribute. Opening an IRA is simple, and most brokerages allow new account holders to start with much fewer than $100.

6. Build up your emergency cash reserves

If you are one of the 74% of Americans living paycheck to paycheck, building an emergency stockpile of cash should be a top priority. Unexpected things happen all the time, and even a small hiccup can throw your budget into a nosedive if you don’t have an emergency fund.

Having an emergency fund with 3-6 months of living expenses in it is a good goal to have, but don’t let that stop you from starting small.

When something does inevitably come up that you didn’t expect, having an extra cash buffer is much better than relying on credit cards and carrying a balance.

Emergency funds help make some situations less stressful. Some examples:

- A global pandemic

- A sudden job loss

- Car repairs

- Vet bills

- An unexpected tax bill

- Travel expenses for a funeral

- Emergency home repairs

7. Start a business

A common myth that pervades our mainstream social dialogue is that you need a lot of money to start a business. Now, more than ever, that is just not true.

The price of entry has been lowered immensely because of the internet. There is nothing stopping someone from buying a domain name and hosting today for fewer than $10. DollarSprout.com — the site you are on right now — is a business that was started on a shoestring budget. What started out as a (very) small business has grown into a viable long-term business that employs a handful of people.

The one drawback to the price of entry being lower today than ever before is that the level of competition is at an all time high. Anyone can start; which means you are competing with a lot of people. Don’t let that deter you; let it motivate you.

Here are some businesses you can start with fewer than $100:

- Blog (like DollarSprout)

- Virtual assistant

- Freelance writer, editor, or proofreader

- Dropshipping business

- Copywriting

For a deeper list of opportunities, check out our online business ideas post or our post on small-scale business ideas.

8. Have some fun with flipping used stuff

Buying something for cheap (or even getting it for free) and then flipping it for a profit is not just a thrill, but it’s a great way to get experience with negotiating, business, and sales.

If you have an extra $100 laying around and you want a true entrepreneurial challenge, hit up your local thrift store or find some garage sales in your town. If you find a good deal on something that you know is underpriced, jump on it.

For people interested in flipping, it’s important to have an end goal in mind. What do you hope to accomplish by flipping? Going all in without a clear goal is probably not the best use of your time since you are essentially starting from scratch every time you go out looking for deals. You aren’t really “building” anything you have equity in — it’s more just a hobby.

Possible goals for flipping:

- Turn $100 into $1,000 and use profits to start a new business

- Complete 10 successful flips

- Experiment with different negotiation techniques and get comfortable with making a deal

9. Take someone you look up to out to lunch

Success in life often comes down to the connections we make and the relationships we build. Relationships don’t happen by accident — you get what you put in.

If there is someone you look up to, whether it’s a business person, real estate investor, church leader, a role-model parent, or anything in between, reach out to them. You don’t need to try to “get anything” out of the lunch, per se. This is all about building a relationship. If you treat people well, good things tend to happen because of it.

10. Invest in your marriage or relationship

Life is too short to only focus on how much money you can make from every transaction. Sometimes the returns we get from our investments have nothing to do with money.

You shouldn’t do this every time, but if you have some extra cash on hand, consider using it to do something out of the ordinary for your partner. It could be a date night, a daytime road trip, getting them that book they’ve been eyeing, or anything else. The most important thing is to make sure that it’s something meaningful to them (and not just to you!).

Don’t neglect your long term financial goals, but also don’t beat yourself up over living a little bit. Money is a tool meant to make our lives better, not stress us out.

11. Join a gym

Rising healthcare costs are a very real thing facing many Americans, and unfortunately they’re not showing signs of slowing down anytime soon. Many health issues are beyond our control, but the one variable we can control is how well we take care of our bodies.

Some of the most prevalent health problems facing our population are self-induced. Heart disease, Type 2 diabetes, stroke, and many other problems are believed to be more common in sedentary people than in people who regularly exercise.

In fact, according to a recent study from The Lancet, “physical inactivity is responsible for a substantial economic burden.”[1] The study estimates that the total economic cost of the doctor visits, lost time from work, insurance claims, and other costs is almost $28 billion in the United States each year.

On average, people who exercise regularly incur fewer healthcare expenses.

Invest in your health and your wallet by joining a gym, if you haven’t already. It’s worth every penny.

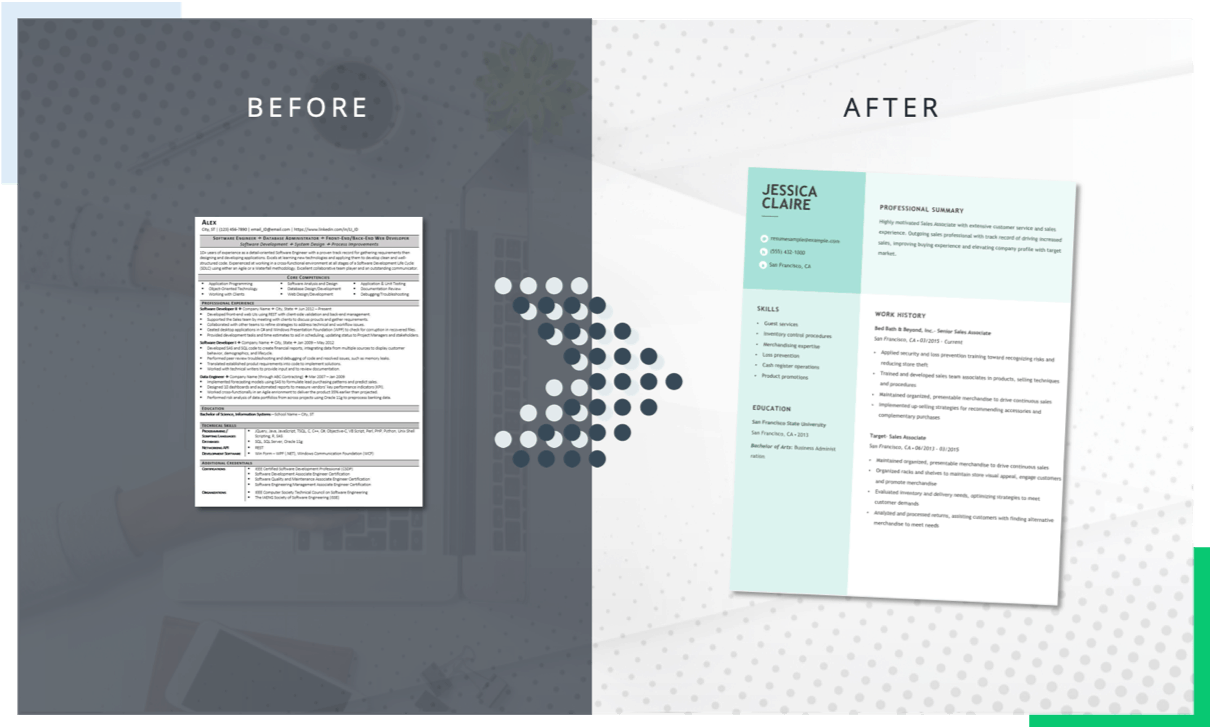

12. Give your resume a makeover

The biggest pay raises that people usually get don’t come from internal promotions with the same company. Most of the time the biggest jumps in pay happen when you get a new job at a different employer.

Since your day job most likely has the biggest impact on your overall income, it’s important to get everything you can out of it, salary wise. If you are thinking about re-entering the job market, or even asking for a raise at your current employer, you need to have a top notch resume.

A well-done resume makeover can turn it from bland to brilliant. The contents of your resume are one thing, but the delivery and presentation are just as important for helping you stand out to a hiring manager. If you don’t have an eye for design, sites like MyPerfectResume have dozens of expertly-designed templates. They even walk you through the process of building a resume step by step and provide suggestions that fit your work experience, all for fewer than $3.

Another option is to hire an expert to go over your resume with you and help you identify areas where you can improve. If a $100 investment here can lead to a new job that pays $5,000 more per year, that is a 50X return on your investment.

Don’t Make These Mistakes with Your First $100

As you do your research and decide how to invest $100, you will likely come across a few ideas that you should stay far away from.

Invest in penny stocks. Penny stocks are usually penny stocks for a reason. Don’t waste your time.

Buy into an MLM. Instead of getting sucked into a multi-level marketing scheme where you will most likely lose money (and friendships), find another business to start where you have more control over your product and sales strategy.

Sports betting. No matter how well you think you know your sports teams, the sports betting game is always rigged against you over the long run. The sports betting industry raked in nearly $1.4 billion in revenue (on over $20 billion in bets). Don’t add your hard earned money to their bottom line.

The Power of Just $100 – And Starting Now

“What’s the point of investing if I only have $100? Any amount I make from it will be so small that it’s not even worth my time.”

This is one of the biggest misconceptions people have about investing. That it’s only worthwhile if you are able to put down a lot of money at once. That couldn’t be further from the truth!

The point of investing $100 isn’t to turn that $100 into $1,000,000; it’s about taking the first step toward changing your financial life — forever. If you can invest $100 once, you can do it again, again, and again. And that is where the magic happens.

Investing is not a “one and done” affair.

It’s a habit that you build one day, one week, one month at a time.

And the sooner you start, the better; even if it’s small.