Saver vs. Spender: 6 Expert Tips for Managing Money in Marriage

Our readers always come first

The content on DollarSprout includes links to our advertising partners. When you read our content and click on one of our partners’ links, and then decide to complete an offer — whether it’s downloading an app, opening an account, or some other action — we may earn a commission from that advertiser, at no extra cost to you.

Our ultimate goal is to educate and inform, not lure you into signing up for certain offers. Compensation from our partners may impact what products we cover and where they appear on the site, but does not have any impact on the objectivity of our reviews or advice.

If you're a saver, but you find out that your partner is a spender with a pile of debt, is your relationship doomed to failure? Rest assured that all hope is not lost. Here's how savers and spenders can manage finances in a relationship.

When you start dating someone, you probably don’t wonder what their credit score is or how much debt they have.

You’re more focused on their personality, how they treat you, and what their friends are like. But as things start to get serious, their finances become an important part of the picture. This is especially true if you’re considering marriage.

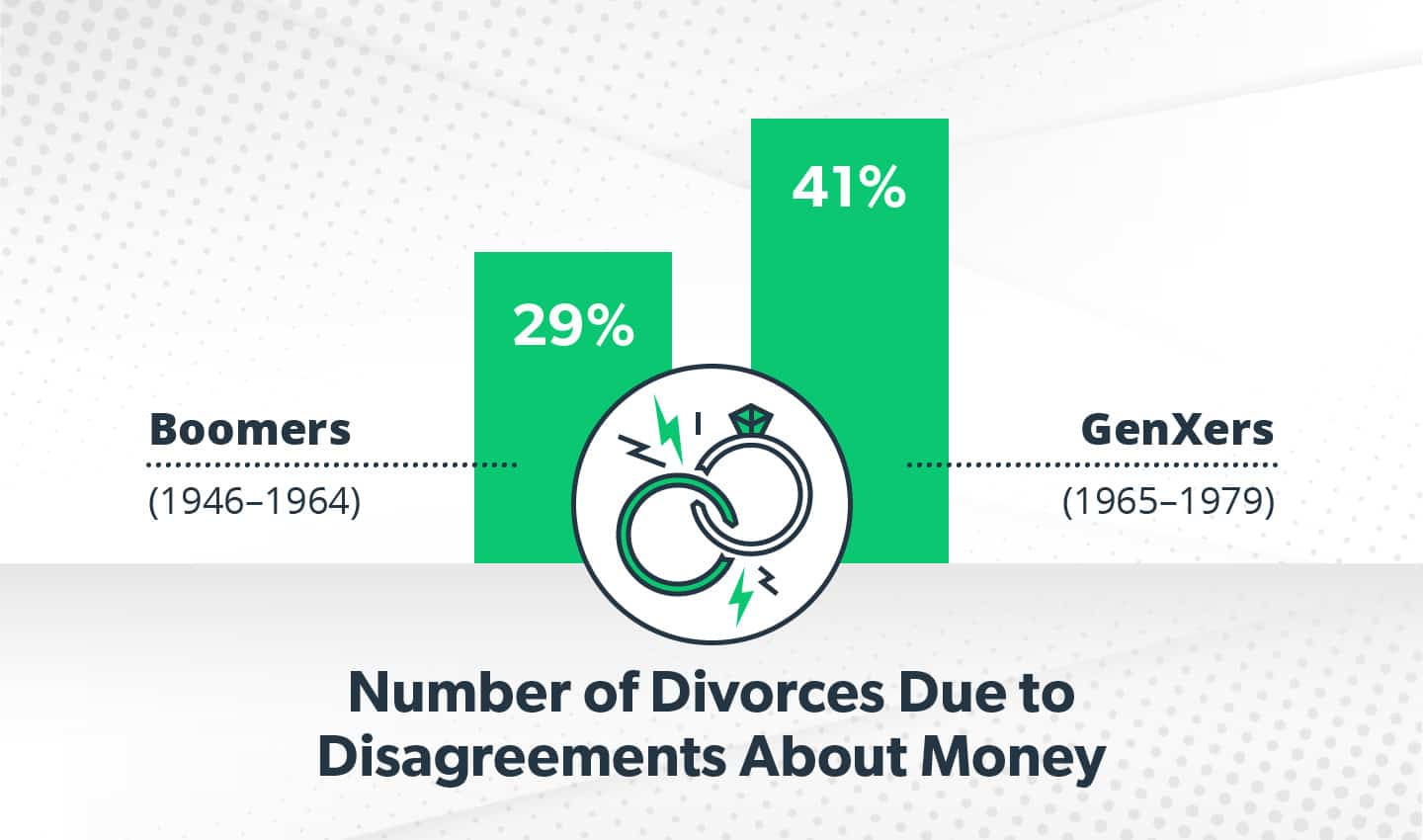

A survey from TD Ameritrade found that 29% of Boomers and 41% of GenXers say they ended their marriage due to disagreements about money.[1]

Statistic source: TD Ameritrade

That begs the question: If you like to save money and live frugally, is it important that your partner does, too? What if they’re the exact opposite? If you’re a saver, but you find out that your partner is a spender with a pile of debt, is your relationship doomed to failure?

Rest assured that not all hope is lost.

How Savers and Spenders Can Manage Finances Together

As a saver, you’re careful about how and when you spend money. You save as much money as possible because it gives you a sense of security. Seeing your net worth go up makes you happy. You also like to allocate your money toward long-term financial goals like buying a house or retiring.

If you’re dating a spender, the way your partner thinks about and handles money is different. They’re more carefree about spending and don’t agonize over every purchase.

When you tie the knot with a spender, you may put yourself at risk for more problems in your marriage. Since you don’t see eye to eye on finances, arguments and disagreements are likely to arise.

Related: 4 Signs Your Partner Isn’t Being Honest About Money

Communication is key

Kelly Smith, a saver, married Jayme, a natural spender. In their first year of marriage, they’d have a big fight any time money came up. Despite the fact that she and Jayme made plenty of money, Kelly was afraid he was going to spend it all.

Eventually, Kelly and Jayme learned how to communicate. The couple made it a priority to talk about their joint goals and dreams and how they’d achieve them. For example, one of their dreams was to go on a cruise to Alaska. They started a fund for the trip and were able to save and pay for it in cash.

Katie Lear, a licensed therapist, said that good communication is essential in a spender-saver relationship.

“Make sure you have money-related conversations regularly at calm times,” she said. “They should not be addendums to fights.”

Lear suggests you set money goals that are positive and realistic as opposed to negative and overly aspirational. For example, resolving to eat out once a week is going to be more attainable than vowing to avoid restaurants for a month.

A spender is more likely to improve their habits if they have a realistic savings goal rather than a strict budget they have to follow. Many need a good reason to save, like starting a new business, buying a vacation house, or taking more trips abroad. The more tangible the goal, the more willing the spender will be to change his or her habits.

Make money a team effort

Haley Neidich, a Licensed Clinical Social Worker, said that savers often feel isolated and alone when it comes to managing their finances. If you’re a saver who is married to a spender, you may believe your spouse doesn’t care about helping you keep track of your finances.

This may result in you doing the work all on your own. Since great marriages are built on teamwork, Neidich encourages saver-spender couples to have weekly meetings to review their finances and spending.

The meeting, which would ideally be about 15 minutes long, shouldn’t be controlled by the saver; it should be a mutual discussion. The purpose is to give both partners the chance to discuss how they did financially over the previous week. Regular conversations can take a lot of pressure off the saver and foster a teamwork mentality.

Acknowledge negative emotions

Neidich said that resentment is common when a saver marries a spender. In most cases, resentment occurs when a spender engages in secretive or compulsive spending and ignores the budget that they agreed upon with the saver. The saver may begin to feel taken advantage of or believe their opinions are being ignored.

This can drive a wedge deeper between them. If a successful marriage is one where both people feel part of a team, then a bad marriage is where each party feels isolated.

To keep resentment from building up, you should communicate any negative feelings early on in your relationship while the problem is still manageable. Resentment usually occurs when you haven’t been able to communicate your needs for a long time.

Setting clear boundaries with money can also help prevent resentment. For example, you can work with your partner to come up with a set amount of discretionary income you can each spend on a weekly basis. Some couples choose to keep separate bank accounts for discretionary spending in order to maintain a level of privacy and autonomy.

Related: Married Couples Should Have Separate Bank Accounts. Here’s Why

Add “spending money” to your budget

Laura Coleman, a saver, and her husband, a spender, each have a set amount of “spending money” they can use every month. They can use it for dinners out, tools, clothes, movies, and anything else they’d like.

When an Amazon package arrives, Coleman’s husband will tell her that he used his spending money on it.

“I don’t get upset because we’ve budgeted for him to spend on a monthly basis,” Coleman said.

Darren Straniero, Certified Financial Planner™ at OnPlane Financial Advisors LLC, is an advocate of this strategy. He believes it allows the spender to shop freely while giving the saver peace of mind knowing that only a certain amount will be spent each month.

Accept that you can’t change your spender

Sometimes, you have to accept that you can’t change your partner’s habits. You can help them improve, but they’re not going to become a saver overnight.

Katie Ryckman is a saver married to Michael, a spender. She said you should be patient with your spender spouse and try to identify why they spend the way they do. Ask your spender what kinds of emotions they feel when they spend money.

Are their spending tendencies a result of how their parents spent money? Do they associate money with love? Use these questions to explore what subconsciously drives your spender’s behavior so you can understand them better.

Once you learn the answers to these questions, you’ll find out why your partner has this type of a relationship with money. When you understand the cause of their spending habits, it’s easier to create a financial plan that works well for both of you.

If you learn they like to spend money on gifts because that’s how they were taught to show love, you may allocate a certain amount of money in your budget toward gifts for one another.

Another option is to encourage them to show their affection without spending money. They may like to buy gifts, but if it stresses you out, then tell them how they can treat you without going over budget. Maybe they could cook dinner, give you a back massage, or write you a love letter instead. These strategies can help keep spending in check while still satisfying their desire to show affection.

Combine finances responsibly

If you’re a saver, you may worry that your spender is hiding purchases from you. For this reason, Straniero suggests you combine finances and share credit cards with your partner. This can increase communication and visibility around what gets spent and saved.

Set up a monthly meeting where you both look over your credit card statements and accounts to see how you’re doing financially. You may find you’re saving a healthy amount and can afford to loosen up and spend a bit more freely. Or you may discover that your spending has outpaced your income, and you need to cut back.

When you combine finances, you automatically increase transparency. Transparency is the key to a healthy financial future as it can keep you out of debt, make it easier for you to budget, and allow you to reach your financial goals together.

Related: Money and Relationships: How to Merge Finances without Any Drama

Get on the Same Page Financially Before You Tie the Knot

Marrying someone who views money differently from you can be a blessing, as long as you agree on how you’ll handle your finances before getting hitched.

“Your spender can remind you to enjoy life and live in the moment while you can add some structure and boundaries to their financial habits,” Lear said.

To ensure your marriage is successful, consider seeing a marriage counselor or financial planner who can help you design a money plan before you walk down the aisle. The money plan will outline things like where you’ll keep your money, how often you’ll talk about money, and what you’ll do to satisfy one another’s savings and spending desires.

Smith and her husband went to pre-marital counseling but didn’t discuss money. Since they were debt-free, they didn’t think it was necessary. She regrets ignoring this conversation early on, as she and her partner spent the beginning of their marriage arguing about money.

If you’re a saver who is dating or engaged to a spender, don’t ignore the importance of money-related conversations prior to marriage. They may be the answer to a happy, healthy future with your special someone.

Related: Should Debt Be a Marriage Deal Breaker? How to Have the Debt Talk