Robinhood Review 2025: Pros, Cons, Fees & How It Works

Trading stocks can be expensive, with fees quickly and eating into your bottom line. But the Robinhood app offers commission-free trading and a user-friendly interface. This review explains how the investing app works and if it makes sense for you.

Some of the links on DollarSprout point to products or services from partners we trust. If you choose to make a purchase through one, we may earn a commission, which supports the ongoing maintenance and improvement of our site at no additional cost to you. Learn more.

Robinhood Overview

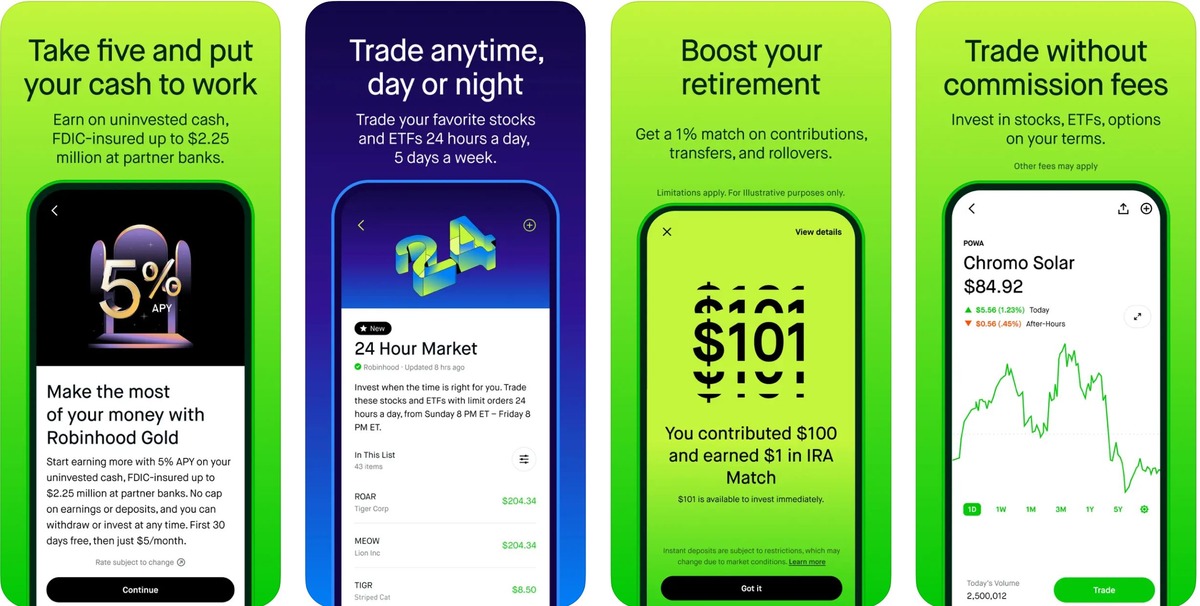

How It Works: Robinhood is a financial services platform that allows users to invest in stocks, ETFs, and crypto commission-free. Its user-friendly interface is designed for beginners, and it primarily generates revenue through order flow payments, margin lending, and interest on uninvested cash.

Cost: 100% commission-free.

Available Asset Classes: Stocks, ETFs, Options, and Crypto.

- Benefits: Easy to use, best-in-class fee structure.

- Drawbacks: No mutual funds, no tax loss harvesting.

Promotion: 1% brokerage account transfer bonus (no cap); 1 free stock sign-up bonus (valued between $5 and $200).

Best for: Beginner investors who don't have access to an employer-sponsored account.

App Design: 4.5 out of 5

Ease of Use: 5.0 out of 5

Fees: 5.0 out of 5

Asset Classes: 4.0 out of 5

Tax Strategy: 2.0 out of 5

>> Visit Robinhood

Robinhood has become the go-to investing app for the younger generation in recent years, largely due to its free trades and snazzy user interface. The app has gained widespread popularity, but it has also faced significant criticism from the media. The main concern is that the app “gamifies” investing, subtly prompting users to trade more frequently than they normally would.

As people have learned from free social media apps, whenever something is free, in most cases, you are the product. Robinhood is no different. But that doesn’t necessarily mean you shouldn’t use the trading platform. In fact, there are many benefits to Robinhood that can make it a better option for investors than other apps.

In this review, I’ll dive into my own experience using Robinhood and share my thoughts on what I think investors should look out for when deciding on an investing app.

What Is Robinhood?

Launched in 2013, Robinhood is a commission-free trading app that allows investors to trade stocks, exchange-traded funds (ETFs), options, and cryptocurrency. The app offers individual brokerage accounts as well as retirement accounts (Traditional IRA and Roth IRA).

They offer a Robinhood Cash Card as well, a debit card that helps users grow their investment account. It does this by rounding up your purchases to the nearest dollar and investing the difference into your Robinhood account (similar to how Acorns works).

There’s no opening minimum for brokerage accounts, but there is a $2,000 minimum for margin accounts. This is a regulatory requirement, so it’s not unique to Robinhood. Robinhood is a commission-free mobile trading app that lets investors trade stocks, cryptocurrency, options, and ETFs with a $0 opening balance. Its streamlined design makes it easy to use, and no annual fees make it a good choice for new investors.

Is Robinhood safe to use?

Robinhood is a member of the Securities Investor Protection Corporation (SIPC), which protects its members up to $500,000, including $250,000 for cash claims. Keep in mind that this only means that your assets are insured should Robinhood become insolvent; it does not mean that your investments are safe from dropping in value. Investing always comes with the risk of losing money.

While the company offers commission-free trading, a simple, streamlined mobile app, and no opening balance requirement, users report multiple complaints ranging from customer service to frequent outages (including one in March 2020 that is subject to a Securities Exchange Commission investigation) to problems with trades, account closures, and money transfers.[1] They also have more reported user complaints than many of their competitors.

Because they don’t provide much guidance or make stock recommendations, and customer reports indicate that support is substandard, it’s important that you learn the basics of investing before signing up for an account. Understanding how the stock market works, including the risks, will help you navigate the platform and make informed choices about your trades and investments.

Portfolio Options

Robinhood offers four primary trading options: stocks, ETFs, options, and cryptocurrency. Although there are no commissions involved when trading with Robinhood, other fees may apply. Be sure you review their fee schedule so you’re not surprised or confused when they appear in your account.

Buying and selling stocks

Stocks are one of the most basic securities you can invest in, and Robinhood is a solid choice for novice investors. They provide a streamlined platform that makes it easy to buy and sell stocks. Open the app, search for the company’s name or ticker symbol, and enter the number of shares you want to purchase. You can sell stocks from your portfolio in the same way.

In addition to being a good choice for novice investors, Robinhood is also good for those who don’t have a lot of money to invest initially. In fact, you can start investing in stocks with Robinhood for as little as $1. Robinhood offers approximately 5,000 stocks to choose from and more than 250 global stocks not listed on American exchanges.

Robinhood also gives users the option to make trades in after-hours or pre-market trading, which is appealing to some investors (but comes with extra risk since there is usually less liquidity).

Fractional shares

A fractional share is what it sounds like — it’s a piece of a stock. When you buy a fractional share, you’re buying a piece of a stock rather than a whole one. Companies like Robinhood offer fractional shares to investors as a way of helping them afford a stock they couldn’t otherwise purchase.

For instance, if you want to buy a share of Apple stock but don’t have enough money to pay for one full share, you can buy a piece of that stock for an amount that fits your budget. However, if you want to sell your fractional share, you must wait until the company has enough pieces to make a whole stock; these smaller pieces cannot be traded on their own.

Fractional shares are a way to diversify your investment portfolio even when you don’t have a lot of money to invest.

Buying and selling ETFs

If you’re interested in buying or selling exchange-traded funds (ETFs), you can do that with Robinhood as well. You can buy and sell ETFs in the same way as stocks. Like all of the trading services offered by Robinhood, ETFs are free to buy and sell. However, ETFs charge management fees to the people who own them.

You’ll pay anywhere from .03% to 1% or more, depending on the ETF you invest in. ETFs are a great way to easily diversify your portfolio without having to buy a bunch of individual stocks. Just make sure you pick funds that have low expense ratios to preserve your returns.

Buying and selling options

Robinhood also allows users to invest in options. Options are a way to bet whether a stock will increase or decrease in value. If, for example, you think a stock that currently costs $10 will increase in value, you can buy an options contract that allows you to buy said stock for $10 at any point before the option’s expiration date. If the stock goes up to $12, you can exercise your option to purchase at $10, and instantly earn a profit of $2 per share.

Buying and selling options with Robinhood is commission-free, and you conduct your trades directly from the app, just like ETFs and stocks. However, investing in options is much riskier than stocks or ETFs, so if you have a low risk tolerance, you might not want to take advantage of this product. Think of options like a casino – there is a very high chance of ruin. In fact, most options traders end up losing money. Beware.

Buying and selling cryptocurrencies

Unlike many of its competitors, Robinhood allows users to buy and sell cryptocurrency, including Bitcoin and Ethereum. Like other trading options, it’s commission-free to buy and sell cryptocurrency, and you can do it right from the app. Keep in mind that you will still need to pay any network fees (or “gas” fees) on a transaction for a particular blockchain.

Should you choose to invest in cryptocurrency using Robinhood, it’s important to note that Robinhood Crypto — which oversees the cryptocurrency branch of Robinhood — is not a member of FINRA, the Financial Industry Regulatory Authority. Additionally, investing in cryptocurrency involves significant risk, so if you are risk-averse or don’t fully understand the risks, this might not be the best investment option for you.

How to Open an Account

Robinhood is a mobile-focused brokerage, so the best way to get started is to download the app and sign up for an account.

After downloading the app, you’ll need to complete an application, which can be done directly in the app. If you’re approved, which typically happens instantly, you’ll receive an email with further instructions on getting started. If you’re not immediately approved, Robinhood will ask for additional information. They’ll provide instructions on what you need to send and how you can do it securely, protecting your personal data.

Once that’s received, you’ll know within five to seven days if you’ve been approved for an account.

Since there’s no minimum balance requirement to open an account, you don’t have to save or commit a substantial chunk of your money to the opening deposit. And if you don’t have money right away, Robinhood gives new users a random dollar amount between $5 and $200 that can be used to purchase from a list of 20 large-cap stocks. According to Robinhood, “The cash value you receive could be anywhere between $5 and $200. Keep in mind that approximately 98% of the participants will receive a reward having a value from $5 to $10.”

You can sell the stock three days after you claim it, but you cannot withdraw the funds to your bank account until 30 days later.

Other Notable Robinhood Features

In addition to trading stocks, options, and cryptocurrency, Robinhood offers a number of other features for its users.

Robinhood Gold

Robinhood Gold is Robinhood’s version of a margin account. This means that you can trade with borrowed money, commonly known as “on the margin.”

If you want to opt into this service, you can try it free for 30 days. After that, it costs $5 per month. However, the free trial only covers the $5 monthly fee, not the margin interest. This means that if you borrow more than $1,000, you will need to pay the interest. Should you try Robinhood Gold and decide it’s not for you, you can cancel it at any time.

As with cryptocurrency and options trading, margin investing can be quite risky. Your losses could end up being larger than the value of your account, meaning you will have to deposit more money to clear the difference. You must understand what you’re getting into. Robinhood offers an explanation; make sure you read it in full before signing up for Robinhood Gold.

Additionally, to have a Robinhood Gold account, you must have a $2,000 minimum balance, per FINRA regulation.

Robinhood Gold members also earn 5% APY ** on their uninvested cash balance, as opposed to 1.5% APY for non-Gold members. ** As of the time of this writing. Be sure to check the site for the most up-to-date APY information.

Refer a friend and get free stock

For each friend that you invite to Robinhood who signs up, makes a deposit, and links a bank account, you (and your friend) will each receive a free stock. This works similarly to the free stock promo for when you initially sign up for Robinhood; Robinhood will notify you of the specific dollar amount that your gift stock is, and then you can choose which stock you would like to buy with that voucher. If the stock you want costs more than the value of your gift, you can buy a fractional share.

You can receive up to $1,500 in stocks per year through this program.

Instant transfers

Thanks to Robinhood’s relationship with a number of national banks, users can transfer up to $1,000, which is instantly available for investing. This is great for people who want to act fast on a trade idea and don’t want to have to wait for funds to clear.

Larger deposits may take up to five business days to process and become available. You can transfer up to $50,000 into your account, and you can only transfer money via direct deposits. They do not accept mailed checks.

Robinhood Alternatives

If you’re about to download an investing app and you are doing your research correctly, you probably came across several other apps that are competing for your business. Here are my thoughts on how Robinhood compares to some of its most noteworthy competitors.

Robinhood vs. Acorns

There are two big differences between these apps: 1) Robinhood is free, whereas Acorns starts at $3 per month, and 2) Robinhood does not have pre-made portfolios to choose from like Acorns has. If you are a true beginner and have no idea what you are doing (and you don’t have any desire to learn), then Acorns might be a better option. If you know the basics and want to reduce your costs, Robinhood is the smarter option in my opinion. Also, if you are investing less than $5,000, the monthly fee for Acorns is a big drag on your portfolio, so Robinhood is definitely better.

Robinhood vs. M1 Finance

Both apps offer commission-free trades. M1 is more focused on overall portfolio management and even offers model portfolios that don’t have any additional fees (outside of the ETF fees, which are standard). M1 also offers a high-yield savings account, as opposed to just offering interest on cash balances in your investing account, like Robinhood does. Both of these factors tilt my opinion in favor of M1 slightly over Robinhood. Robinhood is ideal if you want a hands-on trading experience, while M1 Finance is great for those seeking a more set-and-forget, automated investing strategy.

Robinhood vs. Fidelity

Fidelity, a well-established player in the investment world, offers a more comprehensive range of services and a depth of resources ideal for both beginners and experienced investors. It provides extensive research tools, a wider range of investment options, including mutual funds, and advanced trading platforms. Fidelity’s strength lies in its educational resources and customer support, making it a solid choice for beginners who seek a more traditional, full-service investment experience. Both offer commission-free trading. Robinhood’s design may appeal to a younger audience than Fidelity, but either one is a solid platform for investing.

Robinhood vs. E*TRADE

E*TRADE appeals to a broader range of investors, from beginners to more experienced traders. It provides a more traditional online brokerage experience with a comprehensive set of tools and resources. E*TRADE offers free stock and ETF trades, a wide range of investment options including mutual funds and bonds, and advanced trading platforms with more in-depth analysis tools. If you’re a beginner who anticipates evolving needs and might require more comprehensive tools and resources as you gain experience, E*TRADE is a more versatile option.

FAQs

Robinhood Review: Final Verdict

Robinhood is a solid product and, in my opinion, is perfectly suitable for investors who want to take a more hands-on approach to managing their portfolio.

The commission-free trades and easy-to-use interface are great features, but always remain cautiously on guard; if you find yourself getting “hooked” on the app, take a step back and reconsider what you are getting yourself into. Investing is a long-term game and, if done right, it should be boring.

Related:

- 4 Best Micro Investing Apps for Beginner Investors

- 17 Best Passive Income Apps to Earn Extra Money

- How to Invest $100 for Maximum Return