How to Get Out of Debt: A Step-by-Step Guide for 2025

We all know the basic principles of how to get out of debt. Spend less than you make and put any extra cash towards your debt. But, in practice, organizing what you need to tackle first and how to get started can be overwhelming.

We all know the basic principles of how to get out of debt.

Whether you’re broke, have a low income, or have bad credit, the steps are all the same. Spend less than you make and put any extra cash toward paying off your debt.

In practice, though, organizing what you need to tackle first, and knowing how to get started can be overwhelming. It can leave you feeling trapped and prevent you from getting started altogether.

To help you on your way to financial freedom, we’ve put together this simple, step-by-step guide to help you build a debt payoff plan. It doesn’t matter if you have no money or your income is low. Even with bad credit, you can still put this guide to good use.

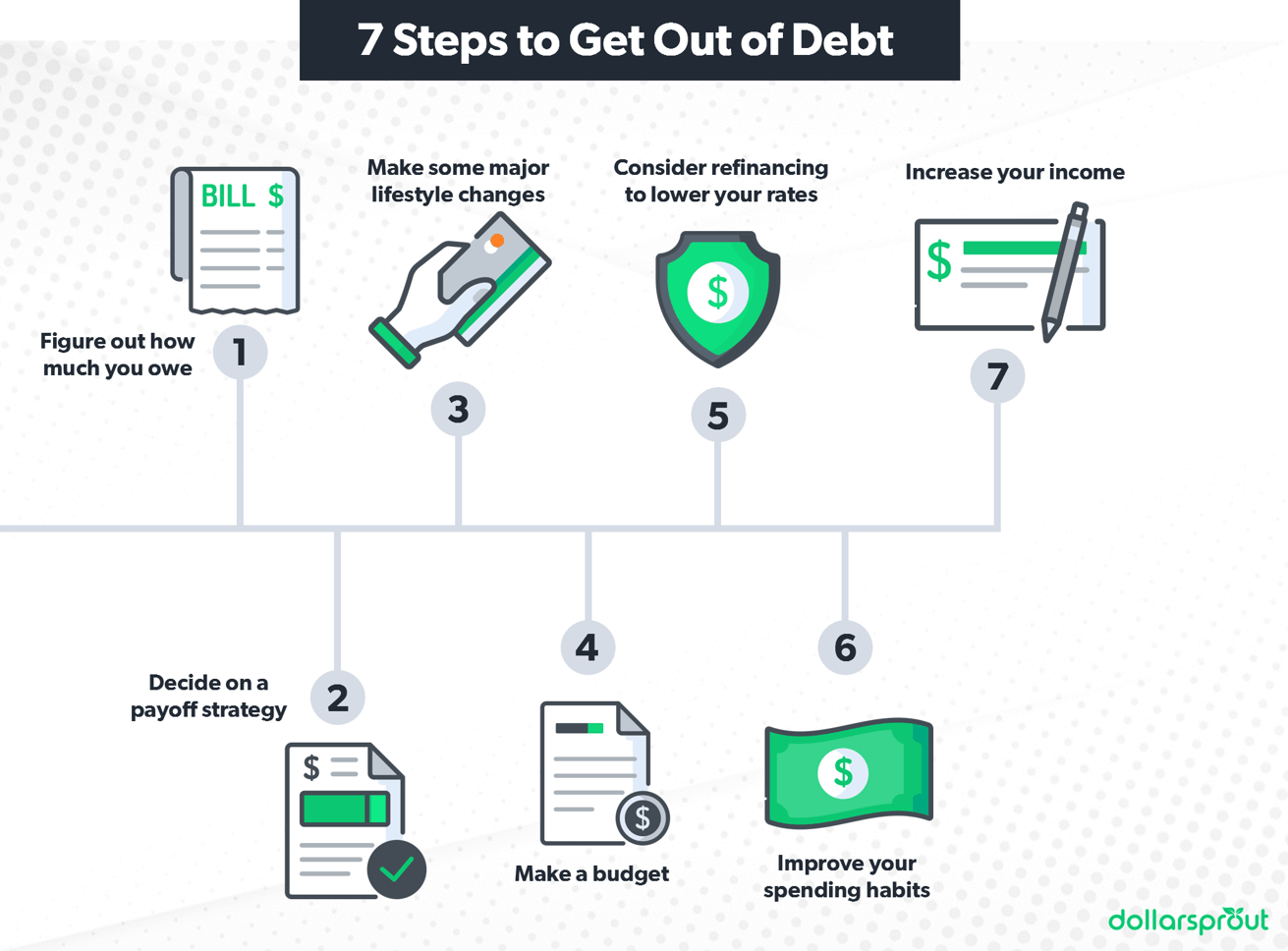

Let’s walk through the steps to help you get out of debt once and for all.

Step 1: Find Out How Much Debt You Owe

You can’t develop a debt payment strategy until you know exactly what you’re up against.

It’s time to gather up all your debts – from that $40 store credit card balance to your $30,000 car loan – and put it all in one place.

Write down the debts you have, how much you owe on each, the interest rate, and the minimum payment.

If you aren’t sure about the interest rate, take the time to open your accounts to find the exact number. High-interest rate debt is a bigger drag on your success than low-interest debt, so you need to know which is which.

Totaling it all up in black-and-white may be scary, but you’re getting ready to cut that number down! Promise yourself that is the highest your debt number will ever be.

Step 2: Choose Your Approach

Once you know exactly how much you owe, it’s time to put a plan together for how you’re going to get out of debt.

Throwing money at a different debt every month, without tracking your progress, is a surefire way to burnout. You’ll feel like you’re spinning your wheels and will give up too soon.

The best way to pay down debt is to focus on one piece of debt at a time until that is entirely paid off. In the meantime, make only minimum payments on the other debts.

This gives you milestones to celebrate, motivates you to keep going, and keeps you organized along the way.

So the question is, how do you decide which debt to pay off first?

There are two main philosophies when it comes to making this choice: the “Debt Snowball Method” and the “Debt Avalanche Method.”

Debt snowball method

In a nutshell: Prioritize your debts from smallest to largest, ignoring interest rates.

Remember making snowmen as a kid? You would start with a small snowball, then roll it along the ground, picking up more snow until you had a massive snowman belly. That’s the concept behind the debt snowball.

With the debt snowball, you start by paying off your debt with the smallest balance, regardless of the interest rate.

While you pay off that debt, you make minimum payments on all the others.

Why is it called the debt snowball? Because the amount you put toward the principal (your balance) snowballs every month. You keep putting the same amount of money toward your debts, even as you pay each one off, increasing the amount that goes toward the principal over interest.

Debt avalanche method

In a nutshell: Prioritize your debts from the highest interest rate to the lowest, ignoring size.

The methodology of the debt avalanche is similar to the debt snowball, except that with this method, your goal is to minimize interest costs. No extra profits for those greedy creditors from you!

With the debt avalanche, you start by paying off the debt with the highest interest rate, regardless of size.

Then move on to the debt with the next highest interest rate.

Why an avalanche instead of a snowball? By eliminating high-interest costs first, you put more of your cash toward actual principal over time. This means getting out of debt somewhat faster (and cheaper).

Decide which debt you will tackle first

What’s more important to you? Getting quick, early wins by paying off small debts, or paying the least amount of interest?

Both the snowball and avalanche methods have their benefits. And while the debt snowball isn’t mathematically the cheapest way out of debt, it is one of the most effective. Pursuing a debt-free life can be a long process, depending on where you are starting. Paying off a few debts early on can really get you excited to keep going.

Action Item: Choose whichever method sounds best for you, then organize your debts in that order. After, you’re ready to start making payments.

Step 3: Make Some Big Changes

While small, day-to-day changes matter, a few big changes can fast-track you to getting out of debt. Consider these ideas and decide whether the expense they represent is truly worth it to you.

Get rid of your credit cards

Are credit cards burning a hole in your pocket? It may be time to cut them up.

If credit card debt is part of your problem, sticking to cash and debit cards can help you reset your spending mindset. Nothing is more discouraging when you’re paying off debt than realizing you increased it accidentally with an impulse credit card purchase.

Once you are officially debt-free and used to spending less than you make each month, you can revisit the issue. In the meantime, credit card rewards don’t offset interest charges.

Sell your car

Have a hefty car payment? Consider selling your car for a cheaper, used model to eliminate the debt and reduce your insurance costs.

Look for good used car deals outside of new car dealerships. You’ll have more room to haggle with private sales and at independent, used car dealers. Just be sure you have a good mechanic look over the car before you buy it.

Don’t have a car payment? Decide whether your family can get by with one car instead of two. Dropping your spouse off at work in the morning might feel like a hassle, but if that extra 15 minutes saves you $500 a month, it might be worth it.

Stop investing (for now)

Saving for the future is essential, but when you have expensive debt that is holding you back, you need to set your priorities. Pulling back on investing in the short-term can put you in a better position to invest adequately in the future. View each dollar you save in interest cost as a dollar wisely invested.

Note: We would never recommend cutting your 401(k) contributions to a point where you don’t receive your full employer match. That’s free money, and the instant return is more than worth whatever you are paying in interest.

Cut cable

Today, you can watch most of your favorite shows online, and even notable sporting events are offering free streaming options.

We watched the Super Bowl last year via Amazon Prime.

If you haven’t cut the cord yet, it’s time! Traditional cable packages run over $100 a month and can be a major drag on your goals – be conscious of how many streaming services you sign up for, though.

Sell your unused stuff

We could all do with a bit of minimizing. But instead of heading to the dumpster with your kids’ old toys and that ice bucket Aunt Marge sent you, list them for sale on Gazelle, OfferUp, or Craigslist.

On average, people have over $1,000 worth of stuff in their house that they don’t use. When we went through our minimizing process, we sold over $1,200 of books, toys, extra kitchen gear, and more.

The fringe benefit of this exercise? You realize how many things you’ve paid good money for that you didn’t really need. That tough reality makes it easier to say no to spending in the future.

Related: How to Make the Most Money Selling on Craigslist

Step 4: Create a Monthly Budget

Want to know how much you can put toward debt each month? You’re going to need a budget.

A reasonable budget helps you understand where your money is going. It alerts you to where cash is leaking out to things that don’t really matter to you. And it clues you in on how much you can afford to spend on the things you do want.

By building a budget thoughtfully and allowing yourself some flexibility, you can reduce money stress by knowing there is always money in the bank for the things you need.

How to make a budget

Before you dive in, remember one thing: the budget you create today is not set in stone.

Your categories, spending, and habits will change over the first few months, and that is perfectly fine! It will take time to adjust to tracking your expenses and creating awareness of your needs.

1. Figure out how much money you make.

Look up exactly how much you get paid each pay period. This is what you have to work with.

2. Define your core expenses.

Housing, utilities, groceries, insurance – These are nonnegotiable expenses and must be covered first.

3. Write out your debt payments.

For now, assume you only make minimum payments on all of your debts since that is the amount required.

4. Create categories for regular expenses and assign reasonable spending limits to each item.

Don’t be afraid to have many budget categories. It will help you have a greater understanding of where things are going. Some regular expenses include internet, cell phone, household goods, medical costs, pets, haircuts, and car/home repairs. Not every item will have an expense each month; but by setting some money aside for those irregular expenses, you’ll be ready when they hit.

5. Allocate remaining money between debt paydown and quality of life expenses.

The money that is left over from your income after completing steps 2-4 is what you have to contribute toward your goals and fun. In addition to debt paydown, you may want to allow for dinners out, gym memberships, gifts, etc. Divide the money in the way that best works for you.

Tip: While you may want to run at your goals full speed, always have some pocket money budgeted. Even if it only covers one Starbucks coffee a month, those little treats will keep you sane.

If you have very little money left over after Step 4, you may need to review your core and regular expenses. Without big lifestyle changes, you may be stuck treading water, finding it difficult to ever fully get out of debt.

As you get accustomed to your budget, don’t be afraid to shift money from one category to another. There is no such thing as a normal month. Don’t go on a spending splurge and completely fall off the tracks just because you didn’t accurately predict the cost of a house repair.

Step 5: Lower Your Interest Rates to Save Money

The less interest you can pay to your creditors, the faster you’ll be able to escape your debt. Check out these top ways to lower your interest rates.

Consider refinancing your student loans

Student loans dragging you down? You may be able to refinance to a lower rate and shorter term.

Reducing the term of your loans, even with a lower interest rate, will likely increase your current monthly payment. But with fewer years of payments to handle, you can save a bundle over time. SoFi, a top student loan refinancing provider, offers one such service. With no prepayment penalties and no hidden fees, it’s an easy way to save thousands of dollars in interest payments over the life of your loan.

Negotiate your credit card interest rates (or consolidate)

Credit card interest rates aren’t set in stone. It is a competitive market out there for credit card companies, which means they have to be flexible to keep customers.

If you’re a long-time customer and in good standing, it doesn’t hurt to call and ask for a reduction in interest rates. More often than not, they will be willing to make a cut to keep you as a customer.

Things to mention to get them on your side? Let them know how long you’ve been a loyal customer and that you would love to stick around. But, also share that other credit card companies are offering you lower rates, even 0% introductory rates for balance transfers and that you can’t ignore the interest savings. Usually, they swing into customer retention mode, and they may be able to pull some strings.

If that’s not an option, consider a debt consolidation loan. If the average APR on your cards is 24% and you take out a personal loan at 12% APR — and immediately pay off your credit card debt — you’ll be left with a more manageable debt to pay off. It won’t solve your debt issue completely, but there is a time and place where debt consolidation makes sense.

Consider a balance transfer credit card

Can’t sufficiently lower your interest rate? Consider a balance transfer, which lets you move debt from one credit card to a different card with a lower rate – sometimes even 0%.

Effectively, you are paying off one credit card with another. But if the rate difference is wide enough, it could save you money. Just make sure you get all the details before starting a transfer. Many balance transfer cards charge a transfer fee of 3% to 5%. And they may have limits on how much you can transfer.

While 0% interest sounds fantastic, only undertake a balance transfer if you are serious about paying down debt. Make sure you can pay off the balance during the 0% offer period. Otherwise, you’re just playing hot potato with your balance.

Step 6: Improve Your Spending Habits

Embracing a frugal mindset will reduce your spending and allow you to pursue your goals more effectively. Not sure where to cut? Start with the big stuff.

Save money on food each month

The average American spends 10% of their budget on food, one of the most significant categories after housing.[1] We have to eat, but do we have to pay so much doing it? Here’s how you can cut.

Stop eating out

Not only is eating at a restaurant more expensive, but it is also harder on your waistline. Meals at restaurants cost more and include larger portion sizes and more fat than the average dinner cooked at home.

Over 40% of the American budget (so 40% of total food spending) goes to food away from home. Eliminate dining out from your budget, at least until you are debt-free.

Avoid impulse buys in the grocery store

Before heading to your weekly grocery store shop, take the time to make a list. Check your grocery store’s online circular and take a look at apps like Ibotta, a free app that gives you cash rebates on grocery store purchases, to see what’s on sale. Then, build a meal plan and list around those items.

Once you’re in the grocery store, stick to your list! To avoid extra purchases motivated by hunger, have a snack before heading to the store.

Learn how to say “no”

Nights out on the town, drinks with coworkers, and shopping trips with friends are tempting. But when it doesn’t fit in your budget, you’re sacrificing your future for a little fun today.

Don’t be afraid to say “no” to any event you can’t afford. You don’t have to isolate yourself in your debt-free journey, just be willing to offer an alternative. Suggesting a game night or potluck at your place could mean more quality time with your friends for a lot less money.

Give up your expensive hobbies

Spending $100 a month on yoga classes just isn’t realistic when you’re hustling to get out of debt. Trade in your expensive hobbies for lower-cost options like free YouTube classes or a monthly book club.

Step 7: Increase Your Income

Frugal living is powerful, but it has a limit. You can’t save more than you make. So, to take your debt-free journey to the next level, it’s time to bring in some more dough.

Ask for a raise

If you’ve been working hard and providing value to your company, it never hurts to ask for a raise.

Don’t just drop the request in your manager’s lap, though. Ask for feedback, develop your skills, and take on more responsibility. Along the way, proactively let your superiors know what you’ve accomplished. You want your manager to know you deserve a raise before you even walk through the door!

Start a side hustle

Commit a few spare hours in your week to something you’re good at, or a task you enjoy, that can be monetized online. Since the average person watches five hours of TV a day, I’m willing to bet you can make the time.

Related: 44 Legit Ways to Make Money Fast

Start a low-overhead online business

The internet has made it easier than ever to start an online business with close to zero up-front costs.

Set up shop as a freelance writer, proofreader, or virtual assistant, and offer your services to other companies that want outside help with hiring a permanent employee. You can work as many or as few hours as you want, with some people turning their businesses into six-figure, full-time jobs.

Get your first clients by reaching out to local businesses, posting about your new business on Facebook and LinkedIn, or listing your services on Upwork.

Putting It All Together

Whether you’re broke and have no money, living on a low income, or have bad credit, just stick to these steps to become debt-free once and for all.

Once you have an action plan for how to get out of debt, achieving debt freedom just requires time. Stay focused on your goal, stick to a budget, trim fat from your spending, and find ways to bring in more income to speed up your journey. Just don’t forget to celebrate all the little wins along the way!