52% of Americans Will Be Forced to Borrow Money If Second Stimulus Isn’t Passed

Our readers always come first

The content on DollarSprout includes links to our advertising partners. When you read our content and click on one of our partners’ links, and then decide to complete an offer — whether it’s downloading an app, opening an account, or some other action — we may earn a commission from that advertiser, at no extra cost to you.

Our ultimate goal is to educate and inform, not lure you into signing up for certain offers. Compensation from our partners may impact what products we cover and where they appear on the site, but does not have any impact on the objectivity of our reviews or advice.

Americans are contributing less to their 401(k), spending more money on unhealthy habits, and regret not cutting expenses sooner in the pandemic.

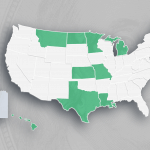

» 40% of Americans report worsening finances as a result of COVID-19. » 52% will need to take on debt if Congress does not approve another stimulus package. » 56% are delaying a major financial decision due to COVID-19. » 35% reported making a financial decision they regret since the pandemic started. » Most common regrets: Not cutting expenses sooner, and not spending first stimulus check wisely. » 18% of Americans who had no credit card debt in 2019 now have recurring credit card debt in 2020. » 31% have reduced 401(k) contributions since the pandemic began. » 32% have adjusted their 401(k) investment allocations at least once since the pandemic began. » 31% say they have increased spending on unhealthy habits in 2020. » 74% support increasing the national debt to support additional stimulus packages. » 52% favor Joe Biden to lead an economic recovery from COVID-19 in the United States. » Nearly 50% of people wouldn't spend more than $50 out-of-pocket on a COVID-19 vaccine. The classic “3-6 month emergency fund” advice that is passed around isn’t enough anymore. Income diversification is just as important. It’s been over 6 months since the COVID-19 pandemic was declared in the United States. For many that have taken even the most aggressive approach to saving a long-term emergency fund, it likely won’t be enough to stave off liquidity issues. While it’s not entirely realistic to expect most people to save a year’s worth of expenses (or more) for a rainy day — on top of saving for retirement — the pandemic has shown that many people need to have a backup plan for earning income. In addition to an emergency fund, people need to develop emergency income streams that they can tap into during difficult times. Even the most money-savvy people are struggling this year. No one is alone. It’s not just the paycheck-to-paycheck, overspending crowd that’s in trouble. Nearly one in five people who did not carry credit card debt in 2019 now have a recurring credit card balance. These are people that know how harmful this type of high-interest debt is, yet couldn’t avoid it this year. To be fair, credit card companies often get a bad rap, but they have been a lifeline to millions of Americans this year. The priority is making it through the pandemic — at the expense of our long term future. Between delaying major financial decisions, cutting back retirement contributions, and even increasing “sin” spending as a coping mechanism, it’s clear that the main priority for many is to simply make it through the pandemic. 74% of people support increasing the national debt to fund an additional stimulus package, which suggests a rare bipartisan agreement that we need to do whatever we can to make it through our current situation. Key Findings:

What It All Means