Consumers Are Tired of High Prices. The Inflation Excuse Is Getting Old.

Our readers always come first

The content on DollarSprout includes links to our advertising partners. When you read our content and click on one of our partners’ links, and then decide to complete an offer — whether it’s downloading an app, opening an account, or some other action — we may earn a commission from that advertiser, at no extra cost to you.

Our ultimate goal is to educate and inform, not lure you into signing up for certain offers. Compensation from our partners may impact what products we cover and where they appear on the site, but does not have any impact on the objectivity of our reviews or advice.

High prices have seemingly lingered long after pandemic-stricken supply chains were (mostly) restored, and consumers are no longer buying the inflation feint.

In a landscape where inflation has become a central economic narrative, the disparity between the expected impact of inflation on prices and the actual price hikes observed across various sectors has sparked a heated debate about corporate practices.

While inflation certainly plays a pivotal role in driving costs up, the extent to which companies have increased prices has led many to question whether these adjustments are solely necessitated by economic conditions or if they also reflect an attempt to capitalize on the situation, thereby padding corporate bottom lines.

The Consumer Price Index (CPI), a measure reflecting the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services, has seen a 5.4% increase over the past year, as reported by the U.S. Bureau of Labor Statistics.[1] This statistic is a clear indicator of the inflationary pressures that consumers are facing.

However, the reaction from businesses, which in many cases involves price increases well beyond what would be justified by inflation alone, has led to accusations of corporate greed.

The stress that financial concerns place on individuals is significant, with 64% of adults citing money as a source of stress, according to the American Psychological Association.[2] This stress is exacerbated by the perception that price increases are not always a direct result of increased costs but also a strategic choice by corporations to enhance profits.

Related: 15 Expert Tips for Beating Inflation

Consumer behavior reflects a growing awareness and dissatisfaction with this trend. A McKinsey & Company survey revealed that 57% of consumers have switched to cheaper alternatives as a direct response to price hikes.[3]

This shift underscores the practical steps consumers are taking to mitigate the impact of rising prices on their budgets, showcasing a direct response to what many perceive as unjustified corporate pricing strategies.

The core of consumer frustration lies in the obvious disparity between the inflation rate and the actual price increases they encounter. This disparity suggests that while inflation does necessitate some level of price adjustment, the extent of these adjustments often exceeds what would be required merely to offset higher costs, pointing towards profit maximization strategies that prioritize corporate earnings over consumer welfare.

Light at the End of the Tunnel

In response to mounting consumer sentiment against high prices, several brands have started to adjust their strategies, signaling a potential shift towards more consumer-friendly pricing.

For instance, major retailers like Walmart and Target have announced price cuts across a range of products, from groceries to electronics, to alleviate the financial strain on shoppers.

This move, aimed at retaining customer loyalty and staying competitive, illustrates a broader recognition within the industry of the need to address consumer concerns over affordability. These efforts reflect an emerging trend where businesses are increasingly prioritizing value and sensitivity to consumer budgets in their pricing strategies.

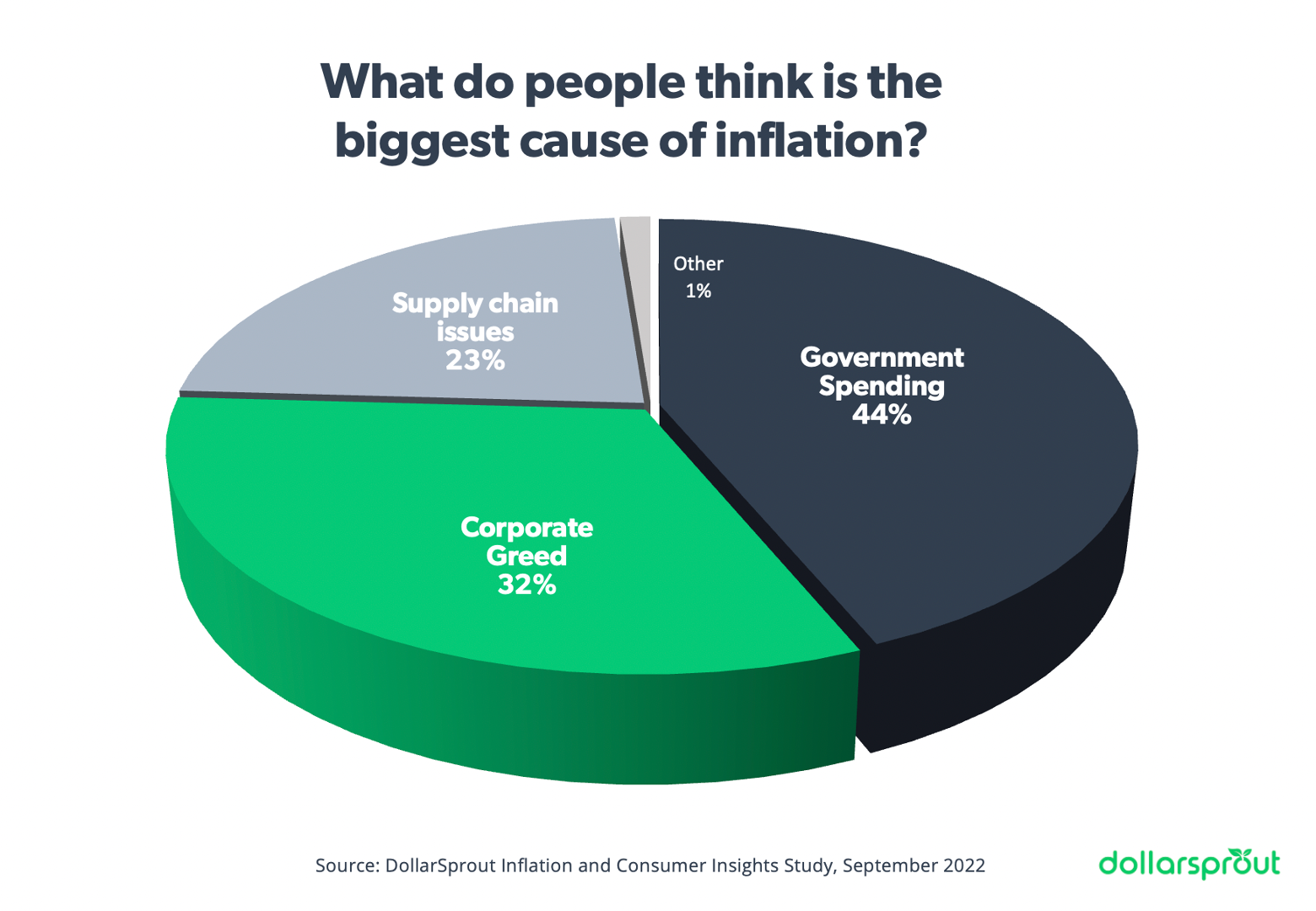

Related: Consumer Survey Reveals Puzzling Responses to Cause of Inflation